guides & resources

ICHRA vs. Wage+: Which Is Right For Your Organization?

Here’s everything decision-makers need to know about their individual health insurance options.

Overview

ICHRA vs. Wage+

After canceling your organization’s group health insurance, you have two options for providing individual plans to your employees. Both ICHRA and Wage+ are managed individual approaches to health benefits. Managed individual health benefits allow employers to provide employees with wage increases to purchase individual health insurance plans on their own. With the managed individual method, employees save an average of $600 per month on a discounted individual health plan, and companies save 30-50% per year.

Employees also have access to Advanced Premium Tax Credits after they switch from a group plan to managed individual. Although not all employees are eligible for APTC’s, nearly 80% of individuals are eligible. These tax credits lower the monthly premium cost for employees enrolled in individual plans through the Health Insurance Marketplace, which makes healthcare even more affordable for your team.

Regardless of your choice, both ICHRA and Wage+ allow your organization to experience the freedom of managed individual. However, it’s important to remember that you must cancel your group plan before you can take advantage of the benefits of a managed individual approach.

What are these models?

What is ICHRA?

An ICHRA, or Individual Coverage Health Reimbursement Arrangement, allows an employer to reimburse employees for healthcare costs, instead of purchasing it for them upfront. Remodel Health’s ICHRA+ model provides employers and employees with a dashboard to help them easily manage their healthcare options.

What is Wage+?

Wage+ is Remodel Health’s proprietary health benefits solution that provides wage increases to employees on behalf of the employer. This model allows employees to explore the Individual Health Insurance Marketplace and choose their own health insurance plan. After an employer chooses Wage+ amounts for each employee, Remodel Health’s software provides options for employees’ healthcare coverage on the Marketplace, as well as outside the Marketplace.

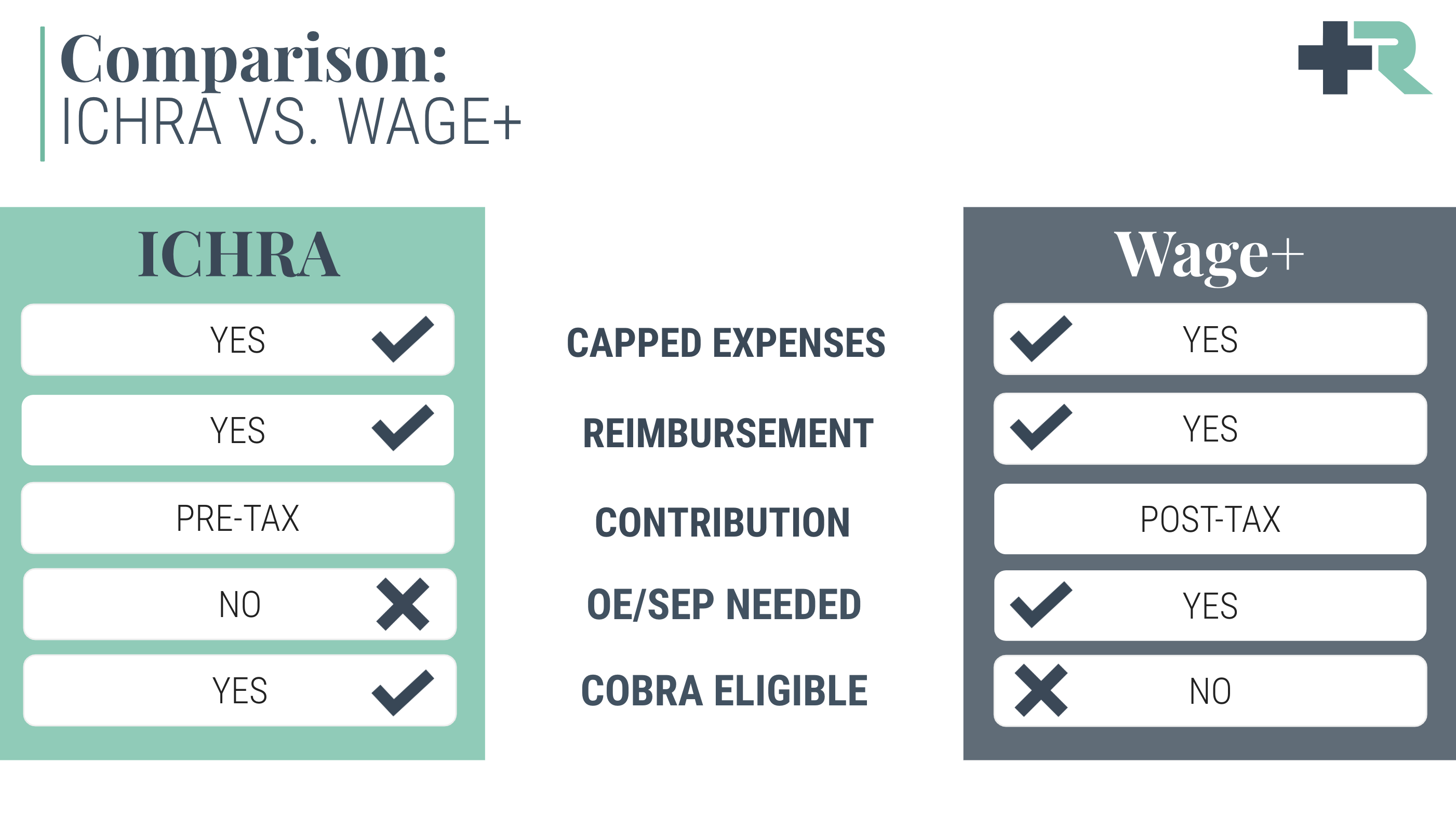

What are the differences?

ICHRA

Using pre-tax dollars as opposed to post-tax dollars is one of the fundamental differences between ICHRA and Wage+. An ICHRA enables employers to use pre-tax dollars to reimburse employees for healthcare expenses incurred while selecting their new individual plan. A pre-tax HRA may be established to cover medical expenses beyond the threshold (as predetermined by the employer) or from the first dollar.

An ICHRA can be started at any time. Employees do not need to wait until Open Enrollment, which makes the transition to individual health insurance easier than ever!

Additionally, an ICHRA is COBRA eligible, while Wage+ does not support this type of job-based coverage.

Wage+

With Wage+, Remodel Health’s software provides assistance when setting monthly allowances for employees’ healthcare coverage. Employees with wage increases will receive a post-tax contribution to cover a percentage of their premium cost.

Once the employee max-out-of pocket is met, employees may submit approved medical expenses for a post-tax reimbursement. Unlike an ICHRA, Wage+ can not be started at any time. If you are planning to switch to Wage+, you have to wait until the Open Enrollment period.

How do these models work?

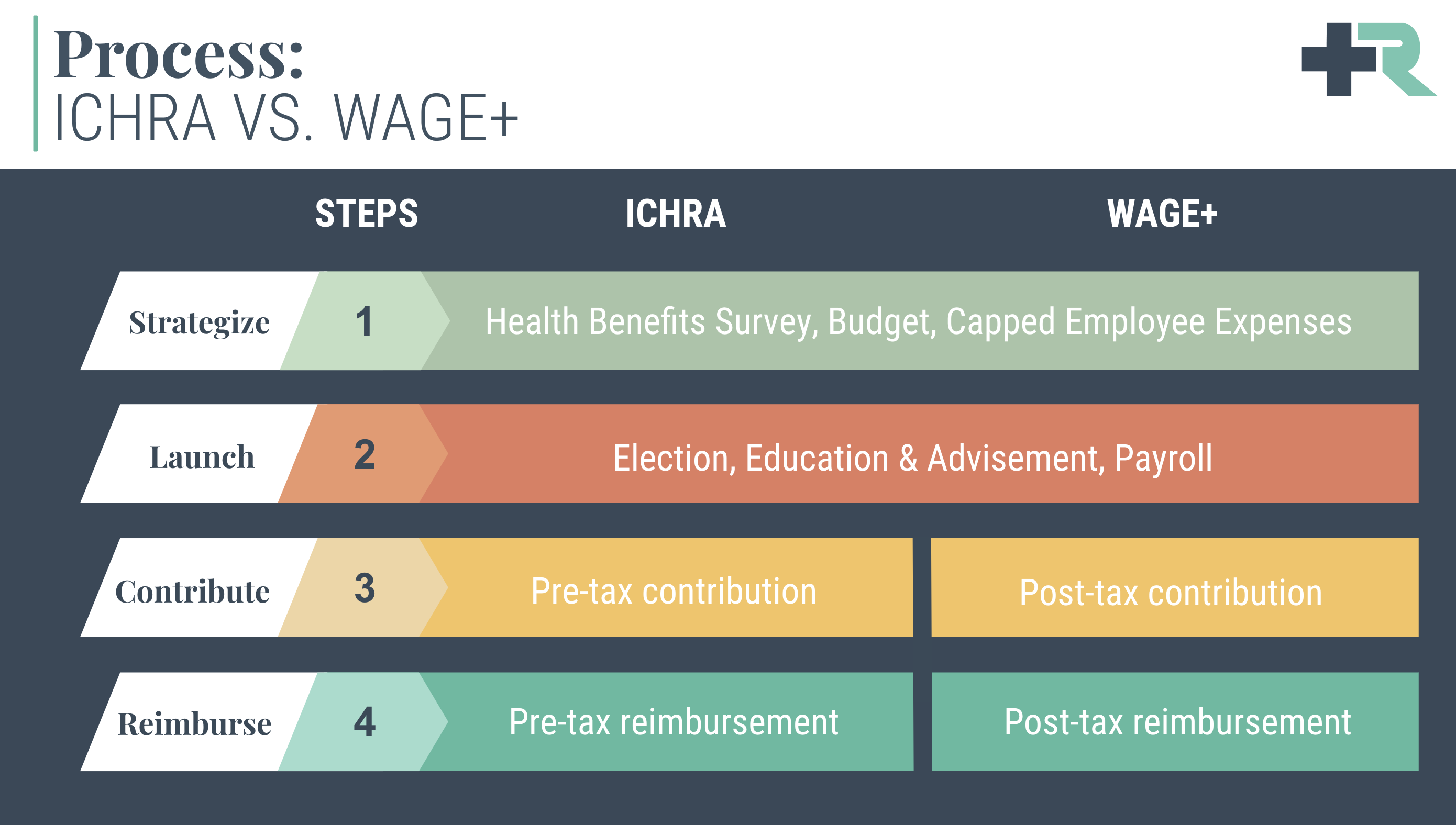

ICHRA

Strategize- Differing contribution amounts will be determined by employers in order for employees to receive an equitable benefit outcome.

Launch- Our team of licensed professionals help employees make decisions about their healthcare coverage. By this point in the process, all finance or payroll administrators will also understand the Remodel Health payroll process.

Contribute- As previously mentioned, employees will receive a pre-tax reimbursement, which occurs before taxes are deducted from an employee’s paycheck.

Reimburse- Employees’ healthcare expenses (beyond the threshold as predetermined by the employer) are covered by the employer through a pre-tax Health Reimbursement Arrangement (HRA). Remodel Health ensures that all reimbursement needs are met.

Wage+

Strategize- A HIPAA-compliant survey will be distributed to employees to gather important information about each employee’s healthcare.

Launch- Employees will have the opportunity to choose a plan that best fits their unique needs. Remodel Health’s licensed advisors will be available to help every step of the way. By this point in the process, all finance or payroll administrators will also understand the Remodel Health payroll process.

Contribute- As previously mentioned, employees will receive a post-tax contribution, which occurs after taxes have been deducted from an employee’s paycheck.

Reimburse- Employees have the opportunity to submit requests for reimbursement for approved medical expenses once their max-out-of-pocket is met. Remodel Health assists with the reimbursement process for all employees.

What are the benefits?

ICHRA

ICHRA’s flexibility and employer-friendly nature makes it a good fit for organizations of any size! These personalized plan options allow employees to successfully tailor their health benefits to what works best for their unique situations.

ICHRAs are also beneficial for employers as they are no longer attempting to keep all their employees happy with just one plan. With an ICHRA, the power of managing health benefits is now in the hands of employees, which makes the process so much easier!

Wage+

If you want to start providing your employees with better benefits, Wage+ is an excellent way to start! With Wage+, employees have the freedom to choose their own health insurance plan that best fits their needs. These wage increases can go toward their own individual plan, their spouse’s plan, or even a sharing program.

One of the biggest advantages for employees is their newly gained access to tax credit discounts, which ultimately lower their plan’s monthly premium. Even if an employee is on their spouse’s healthcare plan, they can receive a wage increase to stay on this plan. Only paying one deductible for an entire household is another benefit of utilizing Remodel Health’s Wage+ model!

What are the drawbacks?

ICHRA

When employees are offered an ICHRA, the affordability of the coverage plays a crucial role in determining their eligibility for Premium Tax Credits (PTCs). If the ICHRA coverage is considered “affordable,” employees automatically become ineligible for PTCs. However, if the ICHRA coverage is deemed unaffordable, employees have the option to opt out and maintain their PTC eligibility. It is important to note that by opting in to the ICHRA, regardless of affordability, eligible employees automatically forfeit their PTCs.

Oftentimes, people don’t like change. Addressing the difficulties associated with changing healthcare coverage is another one of the drawbacks of an ICHRA. However, Remodel Health is here to help you navigate the complex world of healthcare and guide you through the process.

Wage+

Deciding appropriate wage increase amounts for each employee may be difficult. Flat amounts for all employees may seem like the most reasonable way to address this issue, but this can lead to complications.

With Wage+, an employer must evaluate every employee and decide what wage increase amount is adequate in order for all employees to have access to an equitable healthcare solution.

When does this method work best?

ICHRA

Employers who have higher wage earners may want to evaluate using an Individual Coverage HRA. Small and medium-sized businesses benefit from adopting ICHRA because it is manageable, budget-friendly, and easy to understand.

If your organization wants to fulfill the large employer mandate, an ICHRA serves as a feasible option. By utilizing this approach, you will be able to take care of your team in a cost-efficient manner.

Wage+

Since higher wage earners receive less tax credits, this particular model often works best for employers with lower wage earners. Although Wage+ is widely believed to be more difficult to design, your organization will be able to save even more!

How do I make the switch?

Switching to ICHRA or Wage+ with Remodel Health

The process of switching from a one-size-fits-all group plan to a managed individual approach to health benefits is simplified with Remodel Health. After an employer ditches their traditional group plan, there’s a world of possibilities! With managed individual, employees save an average of $600 a month on a discounted individual plan, and companies save 30-50% per year.

Could ICHRA or Wage+ be the answer to your search for new employee health benefits? Get in touch with us to learn more!

on the blog

Expert insights at your fingertips.

Check out our resource library for easy-to-read blogs, videos, guides to big topics, case studies, and more!