guides & resources

Individual Coverage HRA Guide

Here’s everything employers, brokers, and HR professionals need to know about providing an ICHRA to employees.

Overview

What is an Individual Coverage HRA?

An Individual Coverage HRA, or an ICHRA (pronounced “ick-ruh”), is a type of HRA that increases flexibility for both employers and employees to better utilize the Individual Marketplace.

This innovative health benefits solution has been replacing the traditional model of health benefits for millions of organizations across the country since January 2020 when it was established.

Overview: What is an ICHRA?

Reimburse employees tax-free for qualified medical expenses.

An Individual Coverage HRA, or an ICHRA, is an employer-funded Health Reimbursement Arrangement (HRA) in which employers of any size or industry can reimburse employees tax-free for qualified medical expenses.

ICHRA rules allow for an employer of any size to use pre-tax dollars to reimburse employees for healthcare costs, instead of buying it for them upfront. This innovative health benefits solution has been replacing the traditional model of health benefits for millions of organizations across the country since January 2020 when it was established.

quick history of individual Coverage HRA.

Background on HRAs.

The HRA model of distributing tax-free medical dollars to your staff with (near) simplicity has been around for a while. Previously, though, strict rules have limited many employers from taking advantage of this innovative model.

HRAs (Health Reimbursement Arrangements) started in 1974 with the ERISA Act, aiming to slow down rising medical costs. The new law allowed employers to offer employees tax-free reimbursements for healthcare expenses. Unfortunately, it did not succeed in stopping the ever-increasing price of healthcare.

By the time the 2000s arrived, the IRS offered some updates that gave HRAs an opportunity to shine. The changes offered improved flexibility for employers to determine different reimbursement amounts for employees across their organization. Those funds could then be used toward both medical expenses and premiums.

The problem was that while the updates let employers budget better, they did not improve the access and affordability of healthcare for employees. Thus, the Affordable Care Act (ACA) was introduced in 2013. This, however, was not good news for the HRA.

The ACA brought new definitions and requirements to health insurance plans. HRAs actually fell under this new definition of a “plan” and became subject to the requirement of providing Essential Health Benefits as well as having no Lifetime Limit.

HRAs were then considered incompliant unless “integrated” with a fully-insured ACA-compliant group plan.

Background on previous HRA limits.

While the ACA improved access to medical coverage through the Individual Marketplace, its disruption to the industry increased costs for group healthcare even more—especially for companies with under 50 employees.

In an effort to give employers an alternative to canceling plans they could no longer afford, Congress enacted the 21st Century Cures Act in 2016, which included the provision for Qualified Small Employer HRAs (QSEHRA). It allowed small employers to offer dollars to their employees to spend on individual plans.

However, the strict limits on employer size and reimbursement amounts significantly limited QSEHRA’s application pool. Large employers could not use QSEHRA, the allowances were too small, and offering it offset premium tax credits for employees.

In an effort to appeal to these problems, the Trump Administration released an Executive Order in mid-2019 outlining new rules for HRAs. The goal was to increase flexibility for both employers and employees to better utilize the Individual Marketplace. Starting in 2020, Individual Coverage HRAs (ICHRA) have been made available.

How ICHRA is different.

New ICHRA rules allow for an employer of any size to use pre-tax dollars (as opposed to the QSEHRA). They are required to be used in tandem with an ACA-compliant plan, but an employee can use those dollars to pay for their premiums plus qualified medical expenses. More importantly, if the ICHRA allowance is considered IRS unaffordable, the employee may opt-out and use Premium Tax Credits instead.

There are certainly incentives to allow for increased diversity in healthcare spending, which will inevitably increase market competition (which either makes products better or drives prices down). The organization gets to set its budget, and the employee gets better customization on how their dollars will be spent. This ruling is certainly a great addition to the menu of innovative options developed over the past few years.

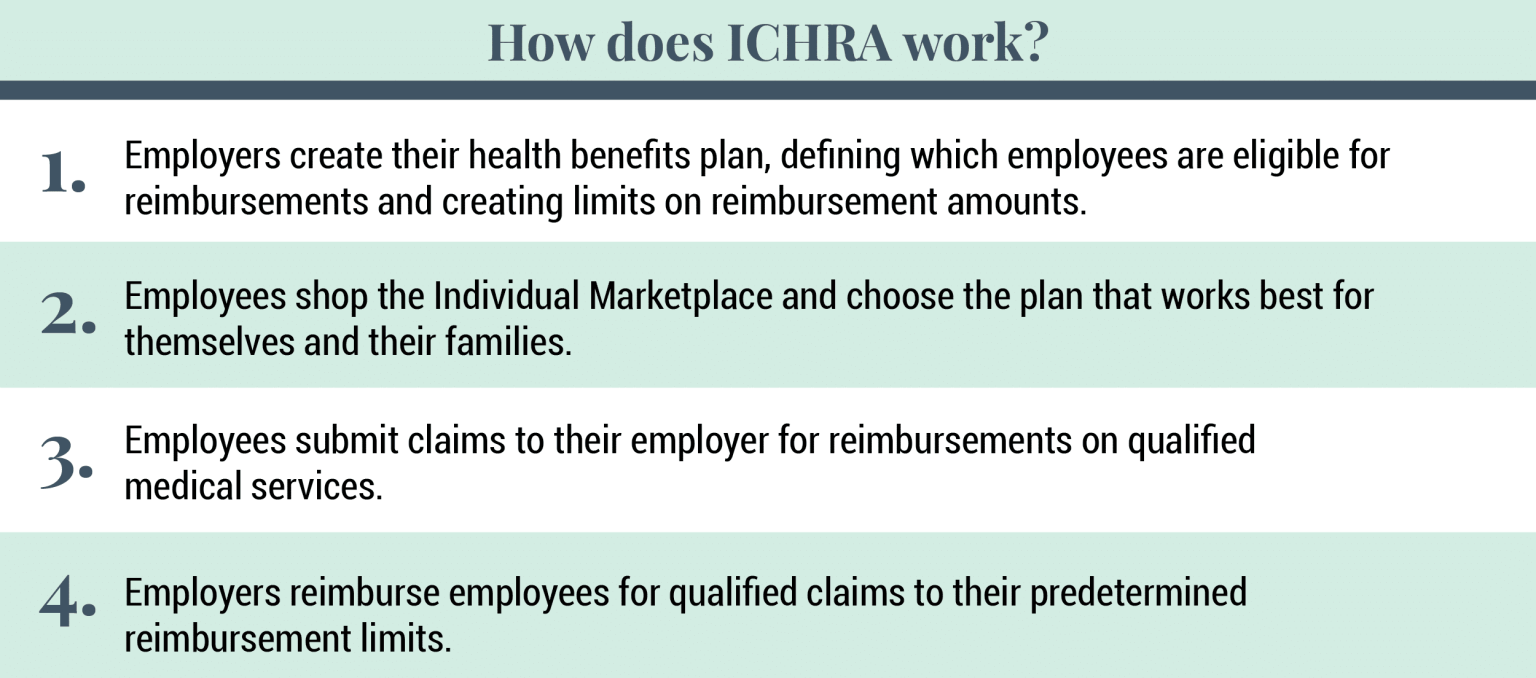

The Rules: How Does ICHRA Work?

Reimburse for healthcare costs instead of buying a plan upfront.

ICHRA rules allow for an employer of any size to use pre-tax dollars to reimburse employees for healthcare costs instead of buying it for them upfront. These tax-free dollars are required to be used in tandem with an ACA-compliant plan, but an employee can use those dollars to pay for their premiums plus qualified medical expenses. More importantly, the employee is able to opt-out of those HRA dollars if it could be more affordable for them to use Premium Tax Credits instead.

Useful methods for setting up an ICHRA.

First, it is essential to know that employers must apply these HRA dollars to everyone equally within any given class of employees (class right now is up for interpretation). However, some useful methods of classifying employees (when consulting with an expert) can provide a more personalized experience in caring for your team.

Second, you cannot double-dip. You can pick either the HRA allowance or your Premium Tax Credit. You cannot use both. By opting into the HRA, you immediately lose your tax credits, which often is a better deal than using an HRA.

Third, while Applicable Large Employers are allowed to use ICHRA, it does not necessarily fulfill the employer-shared responsibility (also known as the “mandate”). If the ICHRA allowance for that individual is considered to be an affordable plan, then the mandate is fulfilled. If not, then either part A or part B of the shared responsibility will be billed to you by the IRS.

Unique features of ICHRA.

One of the best aspects of the new ICHRA is its flexibility and employer-friendly nature. Below are some of ICHRA’s unique features:

- Employers of any size can use ICHRA

- ICHRA fulfills the large employer mandate

- Reimbursements can be used for medical expenses and premiums

- Reimbursement amounts are unlimited

- Employees can be organized into groups with custom allowance amounts

- Allowances do not offset premium tax credits

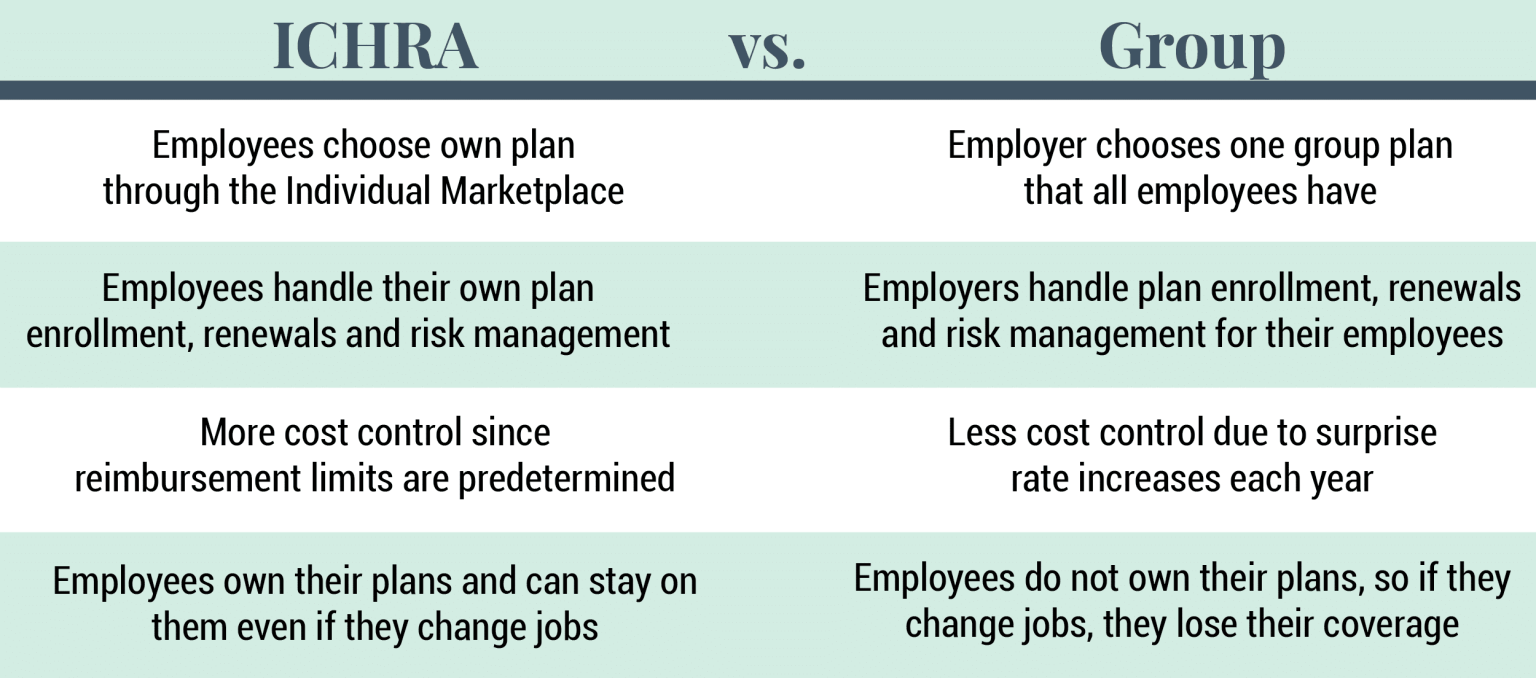

ICHRA vs. Group plans

Control the cost of health benefits with more accuracy.

Many employers are intrigued by the new ICHRA for several good reasons. For one, using a reimbursement strategy allows employers to control the costs of their health benefits with much more accuracy. Plus, the Individual Marketplace allows employees to shop for a plan that suits their unique needs/requirements rather than getting put on a one-size-fits-all group plan. This means employees receive a health benefit that better meets their needs.

Opting for an ICHRA also means employers don’t have to worry about micro-managing the healthcare of their employees. It also takes the pressure off choosing a group plan that meets the far and wide medical needs of their employees — especially a benefit for large employers that could not qualify for QSEHRA previously.

Employees with ICHRAs choose their own plans, handle their own renewals, choose their own doctors, and submit their own reimbursement requests. The employer simply determines which of their employees qualify and how much they will reimburse for qualified medical expenses.

How To get started with an iCHRA.

Software that helps you design your new ICHRA plan.

Are you ready to get started with an ICHRA? Run a no-risk analysis of your organization to see if an Individual Coverage HRA is a good fit for your organization!

Remodel Health’s proprietary health benefits software simplifies the process of setting up a new ICHRA plan for your organization! Our software has been designed to address each opportunity and present itself as the premium offering for employers of any size to leverage each next improvement to health benefits. With the help of our software, you can:

Design & Compare — discover equivalent coverage compared to your old group plan, review exact prices, and design budget strategies across multiple options for lowering the risk to your team and saving on topline costs.

Tax Calculations — ensure all tax situations for individuals and the employer are evaluated through our proprietary algorithm; payroll taxes, large employer shared responsibility payments, and more are handled.

Shopping & Enrollment — enjoy a curated shopping experience that guides each employee to the exact plan that fits their specific needs best.

Autopay & Group Bill — monthly premiums are handled automatically by payroll deduct and one group bill, so you unlock all of the power of individual plans with all the convenience of being organized as a group.

Online Portal — plan documents, training videos, contact details, digital insurance cards, all digitally available.

Year-Round Support — you no longer have to answer every question from your staff and their families, but instead provide them with licensed personal support to get them answers for their plans when they need it.

on the blog

Expert insights at your fingertips.

Check out our resource library for easy-to-read blogs, videos, guides to big topics, case studies, and more!