guides & resources

ICHRA 101 Guide:

A Breakdown of the Basics

Here’s everything employers, brokers, and HR professionals need to know about providing ICHRAs.

Overview

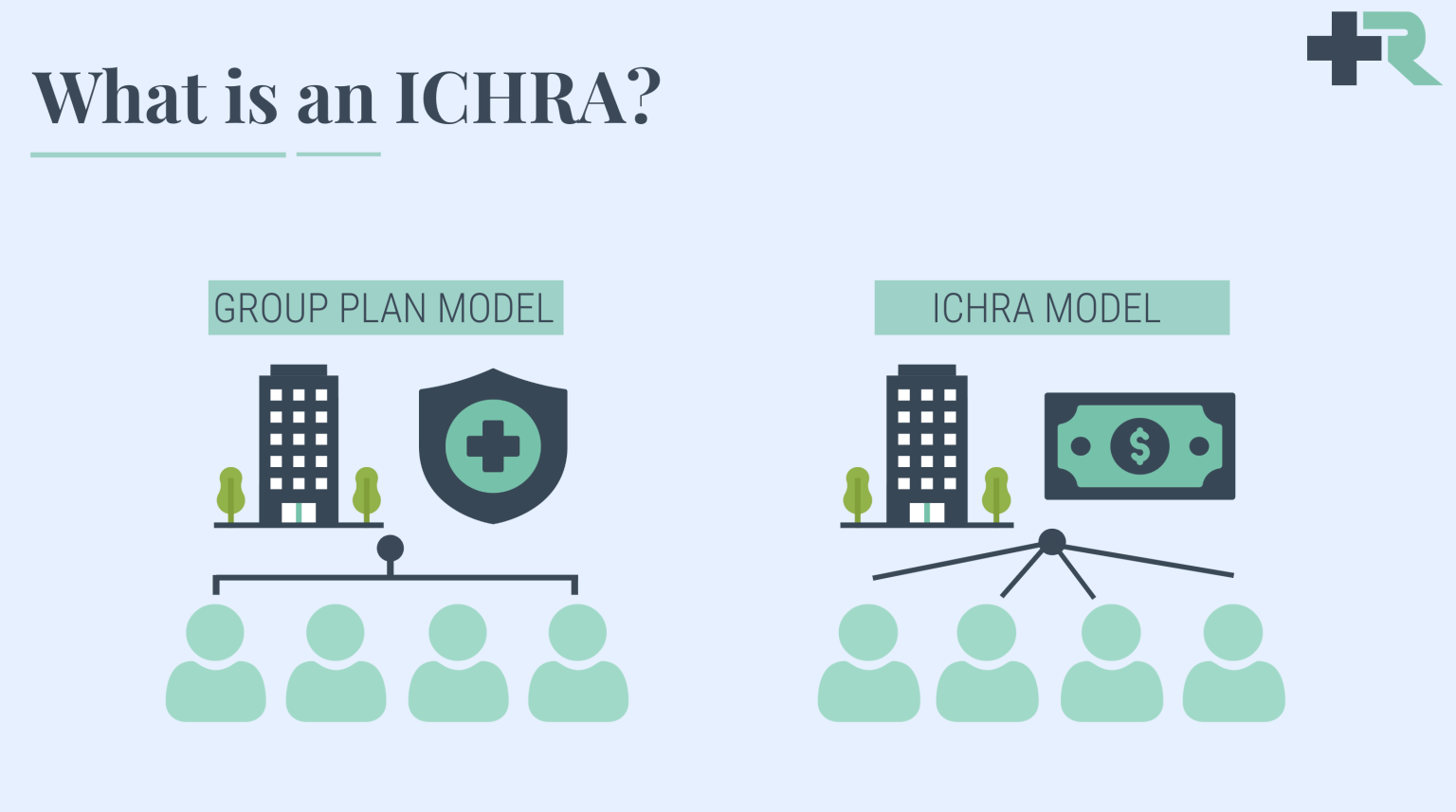

What is an Individual Coverage HRA?

Reimburse employees tax-free for qualified medical expenses.

An Individual Coverage HRA, or an ICHRA (pronounced “ick-ruh”), is an employer-funded Health Reimbursement Arrangement (HRA) that increases flexibility for both employers and employees to utilize the Individual Marketplace better. This HRA allows employers of any size or industry to reimburse employees tax-free for qualified medical expenses.

This innovative health benefits solution has been replacing the traditional model of health benefits for millions of organizations across the country since January 2020, when it was established.

Jump to a guide section:

Why are iCHRAs important?

Simply put, they're a game changer in the health benefits space.

ICHRAs have actively changed the health insurance landscape since their introduction in 2020. The concept of individual health coverage has proliferated, as ICHRA coverage increased 300% from 2022 to 2023. Ultimately, this innovative health benefits solution has replaced the traditional health benefits model for millions of organizations nationwide since January 2020.

ICHRAs allow employers to give employees a set amount of monthly tax-free money. Employees can use this money to buy individual health insurance or pay for medical expenses. They let their employees choose the health insurance plan that best fits their unique needs!

ICHRA coverage increased 300% from 2022 to 2023.

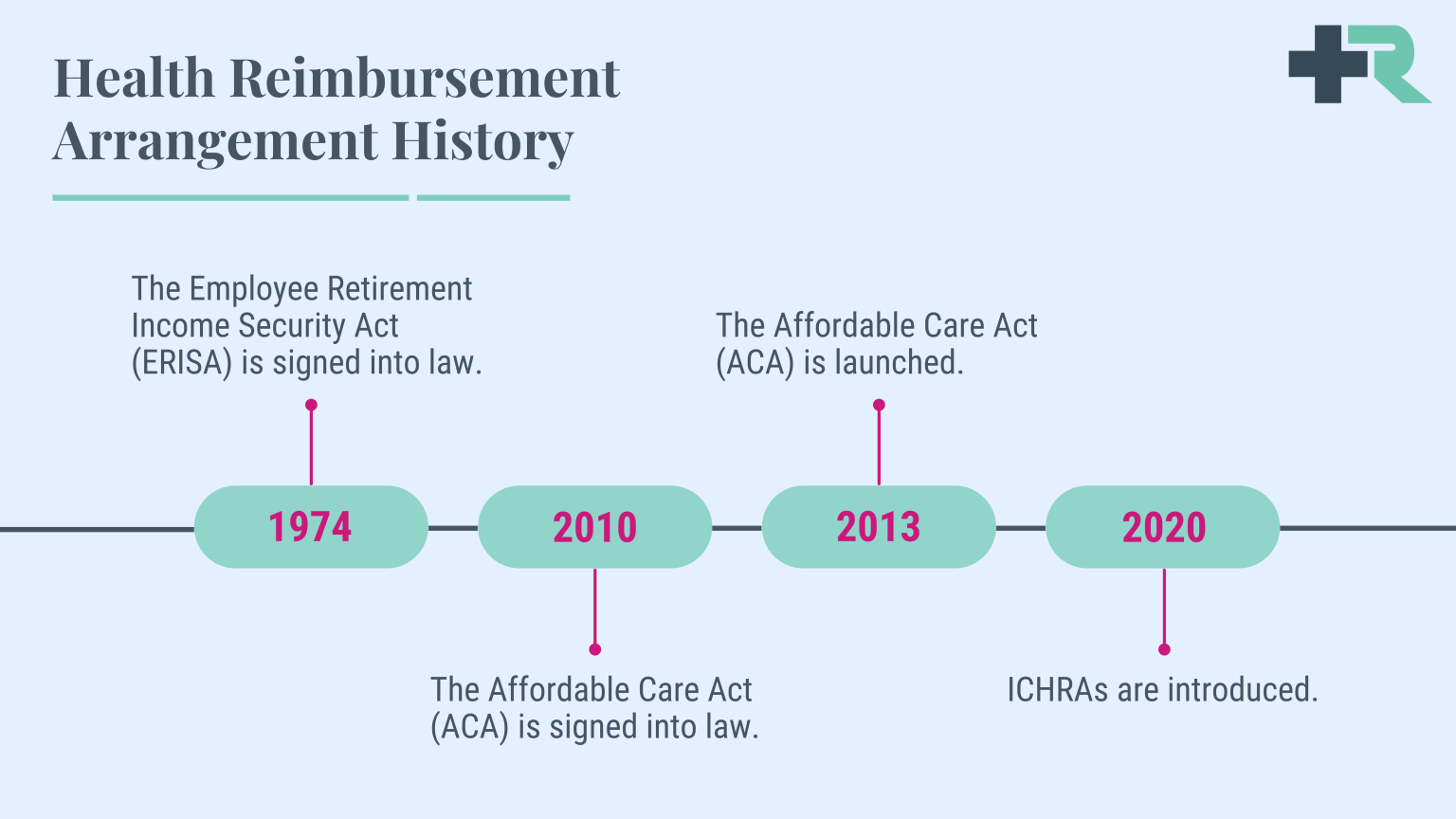

A History of Health Reimbursement Arrangements.

Background on HRAs.

The HRA model of distributing tax-free medical dollars to your staff with (near) simplicity has been around for a while. Previously, though, strict rules have limited many employers from taking advantage of this innovative model. HRAs started in 1974 with the Employee Retirement Income Security Act (ERISA) Act, aiming to slow down rising medical costs. The new law allowed employers to offer employees tax-free reimbursements for healthcare expenses. Unfortunately, it failed to stop the ever-increasing price of healthcare.

By the time the 2000s arrived, the Internal Revenue Service (IRS) had offered some updates that allowed HRAs to shine. The changes improved flexibility for employers to determine different reimbursement amounts for employees across their organization. Those funds could then be used toward both medical expenses and premiums. The problem was that while the updates let employers better budget, they did not improve the access and affordability of healthcare for employees. Thus, the Affordable Care Act (ACA) was introduced in 2013. This, however, was not good news for the HRA.

The ACA brought new definitions and requirements to health insurance plans. HRAs fell under this new definition of a “plan” and became subject to the requirement of providing Essential Health Benefits and having no Lifetime Limit. HRAs were considered noncompliant unless “integrated” with a fully insured, ACA-compliant group plan.

Background on HRA limitations.

While the ACA improved access to medical coverage through the Individual Marketplace, its disruption to the industry increased costs for group healthcare even more—especially for companies under 50 employees. To give employers an alternative to canceling plans they could not afford, Congress enacted the 21st Century Cures Act in 2016, including the provision for Qualified Small Employer HRAs (QSEHRA). It allowed small employers to offer dollars to their employees to spend on individual plans.

However, the strict limits on employer size and reimbursement amounts significantly limited QSEHRA’s application pool. Large employers could not use QSEHRA; the allowances were too small, and offering it offset premium tax credits for employees. To appeal to these problems, the Trump Administration released an Executive Order in mid-2019 outlining new rules for HRAs. The goal was to increase flexibility for employers and employees to utilize the Individual Marketplace better. Starting in 2020, ICHRAs were made available.

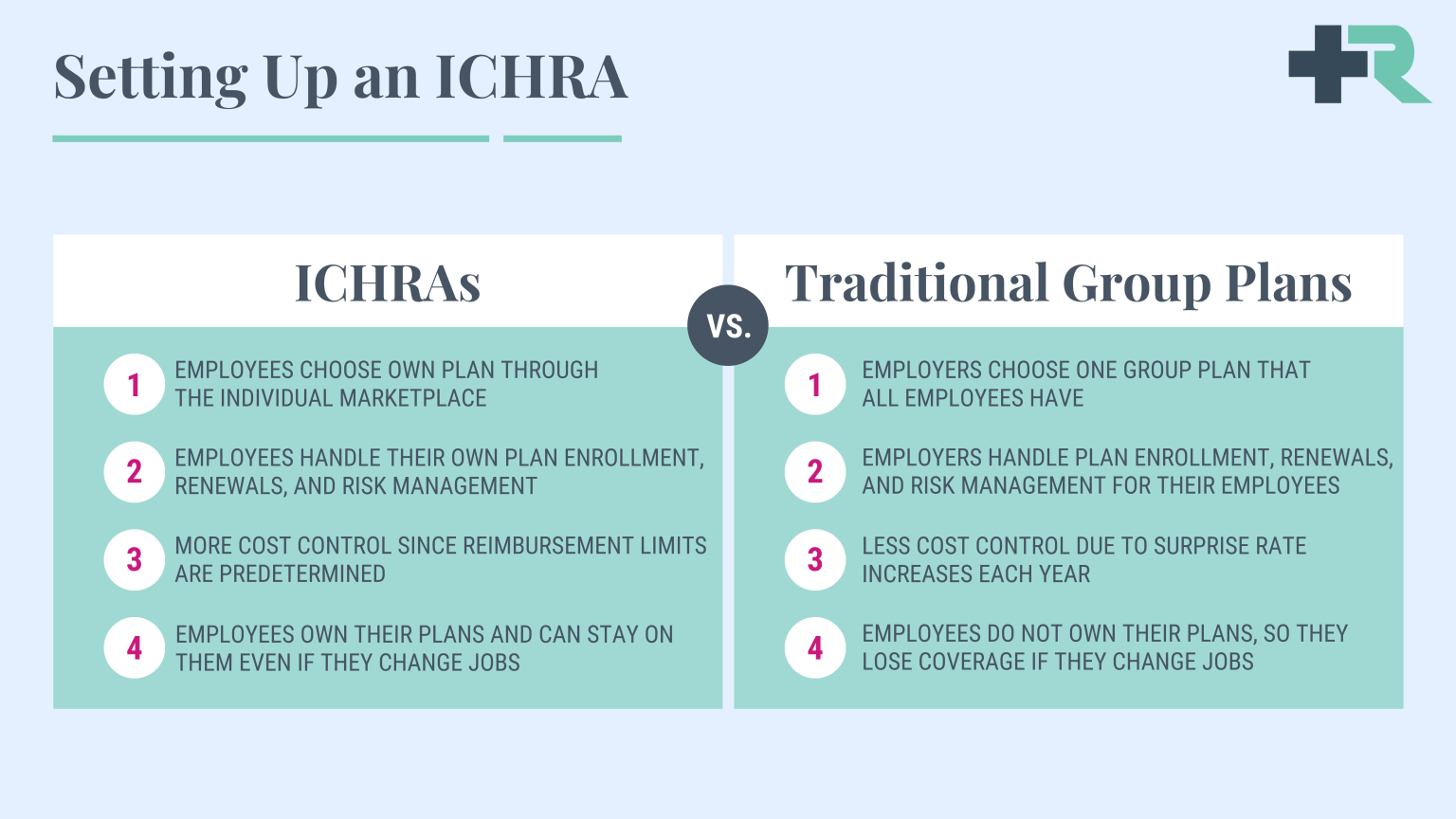

ICHRAs vs. Traditional Group Health Insurance.

Control the cost of health benefits with more accuracy.

Many employers are intrigued by the new ICHRA for several good reasons. For one, using a reimbursement strategy allows employers to control the costs of their health benefits with much more accuracy. Plus, the Individual Marketplace enables employees to shop for a plan that suits their unique needs rather than getting put on a one-size-fits-all group plan. This means employees receive a health benefit that better meets their needs.

Traditional group health insurance usually has a one-size-fits-all approach. The employer selects a group plan, and employees are limited to the coverage provided by that plan. This approach often leads to insurance that might not fit an employee’s health needs or budget. In traditional group health insurance, employers are usually in a guessing game about how much to budget for health benefits year to year. With ICHRAs, employers set their budget, determining how much they will contribute to their employees’ health expenses. This offers more predictable costs for the employer.

ICHRAs encourage personalized health insurance. Employees can select a plan that best suits their unique circumstances—one that covers their preferred doctors and prescriptions and meets their health requirements. The employer determines which employees qualify and how much they will reimburse for qualified medical expenses. The monthly ICHRA allowance can be used for premiums for these personally chosen plans.

The Benefits and Advantages of ICHRAs.

ICHRAs are flexible, budget-friendly, and personalized.

New ICHRA rules allow an employer of an organization of any size to use pre-tax dollars (as opposed to the QSEHRA). They must be used in tandem with an ACA-compliant plan, but an employee can use those dollars to pay for their premiums plus qualified medical expenses. More importantly, if the ICHRA allowance is considered IRS unaffordable, the employee may opt out and use Premium Tax Credits instead.

There are certainly incentives to allow for increased diversity in healthcare spending, which will inevitably increase market competition (which either makes products better or drives prices down). The organization sets its budget, and the employee gets better customization on how their dollars will be spent. This ruling is undoubtedly a great addition to the innovative options developed over the past few years.

ICHRAs are a flexible, budget-friendly, and personalized health benefit option. They provide a welcome deviation from the traditional group health insurance model, giving employers and employees more control and choice. With these benefits, it’s not hard to see why more and more organizations are considering this new approach. Some of the top benefits of ICHRAs include:

- Empowerment and Choice - Employees can choose the health insurance that meets their needs. This can lead to higher satisfaction with health coverage.

- Tax Benefits - Both employers and employees can save on taxes. The money provided through ICHRAs isn’t subject to payroll or income tax.

- Budget-Friendly - Companies can decide how much they want to contribute, giving them control over their healthcare budget. No more surprises!

- Flexibility and Scalability - Whether you’re a small startup or a corporate giant, ICHRAs can be tailored to fit your organization’s size and needs.

- Attract and Retain Talent - Offering personalized health benefits with ICHRAs can increase your company’s appeal to current and prospective employees.

Ready to learn more about ICHRAs?

Our health benefits experts are here to help.

Maximizing Your Tax Savings with ICHRAs.

Take advantage of tax-deductible business expenses.

ICHRAs provide numerous tax advantages for employers and employees alike. ICHRA reimbursements are tax deductible for both employers and their employees, and they don’t need to be recognized as income tax—a sizable tax benefit for both parties. ICHRAs are a highly effective means of reimbursing employees for eligible health expenses. Keep reading to learn more about the various tax advantages ICHRAs provide.

ICHRA tax benefits for employers.

The primary tax benefits for employers are business expense deductions and the exclusion of payroll taxes. Below, we’ve gone into detail about each of these tax benefits:

- Business Expense Deductions – The contributions employers make toward their employees’ ICHRA benefits are tax-deductible business expenses. This permits employers to decrease their taxable income, lowering tax liability.

- Payroll Tax Exclusions – Employers will be happy to know that ICHRA contributions are not subject to payroll taxes, such as Medicare and Social Security. Subsequently, this helps employers obtain additional cost savings that they wouldn’t otherwise get when offering traditional group health insurance plans.

ICHRA tax benefits for employees.

The primary tax benefits employees can take advantage of include tax-free reimbursements and health savings account (HSA) compatibility.

- Tax-Free Reimbursements – Most reimbursements received through ICHRAs are tax-free for employees. Therefore, because this money is not taxable, it can result in employees obtaining significant tax savings.

- HSA Compatibility – Employees with an ICHRA and a high-deductible health plan (HDHP) can leverage and contribute to HSA compatibility. Any contributions are made on a pre-tax basis, which reduces the employee’s taxable income.

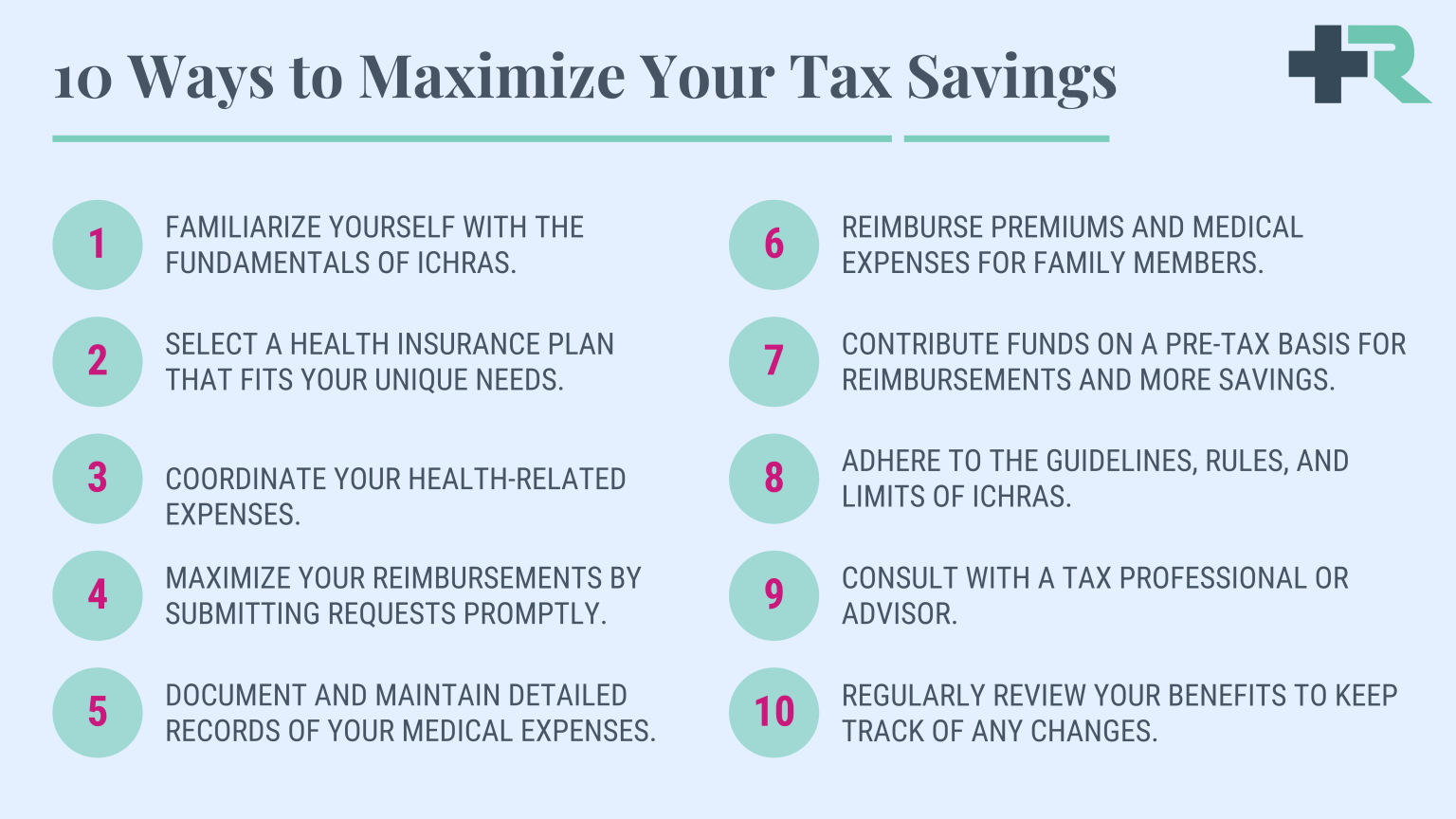

How to maximize your tax savings.

The opportunity for financial gain shouldn’t be passed up, especially when made to be so easy. Here are 10 ways to maximize tax savings with ICHRAs:

In contrast to traditional group health insurance, ICHRAs are flexible and can be offered by employers of any size.

Who Can Participate in an ICHRA?

Background on ICHRA participation.

In contrast to traditional group health insurance, ICHRAs are flexible and can be offered by employers of any size to their employees. No minimum participation requirements or restrictions are based on industry or location.

Moreover, employers can segment their workforce into different classes. These classes can be defined based on job criteria such as full-time vs. part-time status, seasonal vs. permanent employees, employees working in other geographical locations, salaried vs. hourly employees, employees in different divisions or units, and more.

Notably, within each class, the offering must be consistent. Employers cannot offer an ICHRA to some employees within a class and a traditional group health plan to others. However, they can vary the amount of ICHRA funds based on the employee’s age and the number of dependents. To participate in an ICHRA, employees must also have individual health insurance coverage through the Health Insurance Marketplace, Medicare, student health insurance, a spouse’s plan, or another source. Employees must provide proof of this coverage.

Determining Eligibility for an ICHRA.

Determining eligibility for an ICHRA is relatively straightforward.

The essential eligibility criteria are met as long as an employer wants to offer it, and the employees have individual health insurance. Below are the steps for determining eligibility:

- Employer Decision – The employer must first decide to offer ICHRAs based on the company’s budget, administrative capacity, and the desire for flexibility in health benefits.

- Employee Classification – Next, the employer defines classes of employees to whom the ICHRA will be offered. As mentioned earlier, these classes are based on job criteria.

- Proof of Individual Coverage – Finally, for an employee to participate in an ICHRA, they must have individual health insurance coverage and be able to provide evidence.

- Enrollment Period – The employee must enroll in the ICHRA during the defined enrollment period, which typically coincides with the employer’s benefit year.

Medical expenses covered by ICHRAs.

A comprehensive list of covered medical expenses.

- Health Insurance Premiums – ICHRA funds can be used to pay for individual health insurance premiums, including policies purchased through state or federal marketplaces, private exchanges, or insurance carriers. This flexibility allows employees to choose plans that best suit their personal and family needs.

- Prescription Drugs – Prescription drugs prescribed by a healthcare professional are generally covered under an ICHRA. Individuals can utilize their allocated funds, from essential maintenance medications to acute treatments, to meet their prescription needs.

- Doctor and Specialist Visits – ICHRA funds can be used to cover the costs of visits to primary care physicians, specialists, and other healthcare providers. This includes routine check-ups, consultations, and necessary medical treatments.

- Hospital and Surgical Services – Inpatient and outpatient hospital services, surgical procedures, and associated fees are generally eligible expenses under ICHRA. This gives individuals financial support for necessary medical interventions, ensuring they can access quality healthcare when needed.

- Diagnostic Tests and Laboratory Services – From X-rays and MRIs to blood tests and lab work, ICHRA funds can be used for various diagnostic tests and laboratory services. These essential services aid in accurate diagnosis and appropriate treatment planning

Restrictions and limitations on expenses.

While an ICHRA provides significant flexibility, knowing the restrictions and limitations associated with eligible expenses is essential. Here are a few key considerations:

- Over-the-Counter Medications – Except for insulin, over-the-counter medications are generally not considered eligible expenses under an ICHRA. This change was introduced with the CARES Act in 2020.

- Alternative Treatments and Procedures – ICHRA funds may not cover expenses related to alternative treatments, experimental procedures, or services that are not considered medically necessary.

- Cosmetic Procedures – Cosmetic procedures, such as elective surgeries or treatments performed for aesthetic purposes, are typically not eligible expenses under an ICHRA. However, exceptions may apply in cases where they are deemed medically necessary.

- Non-Medical Expenses – Expenses unrelated to medical care, such as gym memberships, vitamins and supplements, and general well-being programs, are generally not eligible under an ICHRA.

Your comprehensive guide to setting up an iCHRA.

Everything you need to know.

First, it is essential to know that employers must apply these HRA dollars to everyone equally within any given class of employees (class right now is up for interpretation). However, some practical methods of classifying employees (when consulting with an expert) can provide a more personalized experience in caring for your team.

Second, you must do something other than double-dip. You can pick either the HRA allowance or your Premium Tax Credit. You cannot use both. By opting into the HRA, you immediately lose your tax credits, which often is a better deal than using an HRA.

Third, while Applicable Large Employers can use ICHRA, it does not necessarily fulfill the employer-shared responsibility (also known as the “mandate”). If the ICHRA allowance for that individual is affordable, then the mandate is fulfilled. If not, then either part A or part B of the shared responsibility will be billed to you by the IRS.

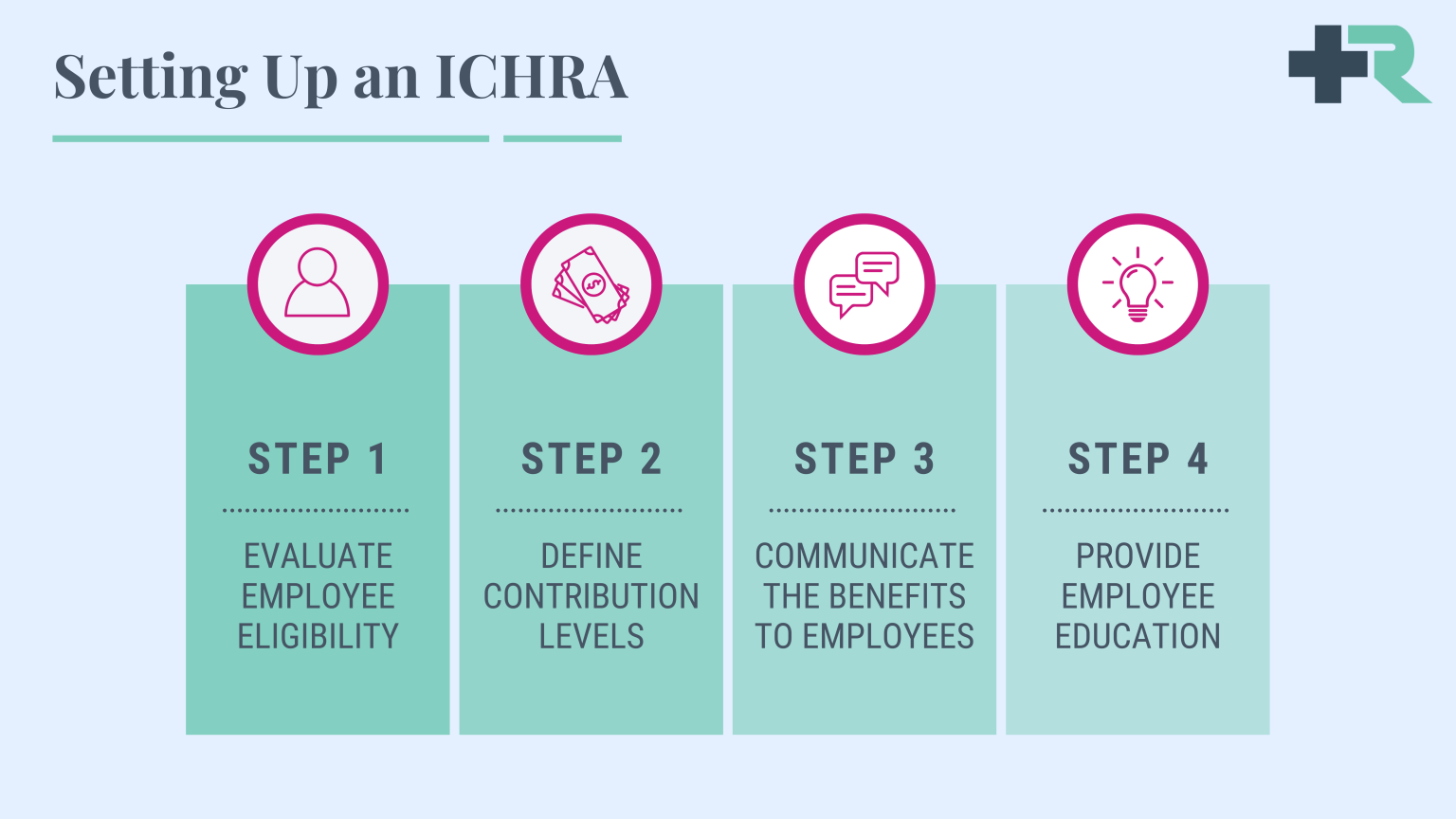

Setting up an ICHRA in four easy steps.

- Evaluate Employee Eligibility – Determine which employees will be eligible for an ICHRA. Employers can offer different classes of employees different reimbursement levels, so it’s essential to define the classes and criteria for eligibility, such as full-time or part-time status, geographic location, and more.

- Define Contribution Levels – Establish the maximum reimbursement amounts for each employee class. An ICHRA provides flexibility to allocate different contribution levels based on various factors, allowing employers to tailor the reimbursement amounts to meet the specific needs of their workforce.

- Communicate the Benefits to Employees – Thoroughly communicate the details of the ICHRA program to your employees. Explain the benefits, reimbursement process, and any important deadlines or documentation requirements. Clear and timely communication is essential to ensure employees understand the advantages of an ICHRA and how to make the most of it.

- Provide Employee Education – Offer resources and educational materials to help employees navigate and make informed decisions about individual health insurance.

ICHRAs allow employers to provide personalized healthcare benefits to their employees while managing costs effectively.

ICHRA Administrative Requirements and Best Practices.

Successfully set up and manage an ICHRA program.

Implementing ICHRAs allows employers to provide flexible and personalized healthcare benefits to their employees while managing costs effectively. By following the outlined steps and adhering to administrative requirements and best practices, organizations can successfully set up and manage an ICHRA program that meets the unique needs of their workforce.

- Compliance with Regulations – Ensure compliance with all applicable laws and regulations governing ICHRAs, such as the ACA and IRS guidelines. Partnering with an experienced ICHRA administrator can simplify navigating its complex regulatory landscape.

- Documentation and Record-Keeping – Maintain accurate and detailed records of all ICHRA-related transactions, including reimbursements and employee enrollment information. Documentation should be readily accessible and organized to simplify auditing and reporting requirements.

- Ongoing Program Management – Regularly review and update the ICHRA program to align with evolving employee needs and regulatory changes. Evaluate the program’s effectiveness, gather employee feedback, and make necessary adjustments to ensure its success.

- Employee Support and Engagement – Encourage employee engagement by offering regular educational sessions, webinars, or workshops to inform employees about their healthcare options and the benefits of an ICHRA. Provide access to dedicated support channels where they can seek guidance or resolve any issues.

Ready to learn more about ICHRAs?

Our health benefits experts are here to help.

Effectively Communicating ICHRA Benefits.

Display the ICHRA benefits effectively.

Effective communication of benefits and company policies can be an intricate task, and it becomes even more critical when the subject at hand involves your employees’ healthcare options. One option is the ICHRA. As a concept that might be unfamiliar to many employees, it is essential to approach ICHRA benefits communication thoroughly and clearly. We will provide practical tips to effectively communicate ICHRA benefits to employees and address common concerns and questions among employees. To display the ICHRA benefits effectively, we recommend the following:

- Be Transparent - It is essential to explain the provisions of an ICHRA clearly. Include the basics—what an ICHRA is, its significance, eligibility, and how it works. Emphasize how an ICHRA offers more personalized healthcare options.

- Use Simplified Language - Opt for easy-to-understand language to explain an ICHRA and how it benefits employees.

- Distribute Informational Material - Reports, brochures, or emails can effectively educate employees. Healthcare.gov also provides valuable information about the benefits of switching to individual health insurance.

Addressing Common Concerns and Questions.

Effectively communicate with employees.

A significant part of communication is addressing the concerns and questions of employees. Here are some common ones:

Partner with Remodel Health for ICHRA Implementation.

Design your new ICHRA plan.

Remodel Health provides the support your employees need while navigating the ICHRA landscape. Our software helps employees understand their healthcare options and provides personalized plan selection tools. Our licensed benefits advisors can give customized advice to employees to guide them through decision-making.

Are you ready to get started with ICHRAs? Remodel Health can run a no-risk analysis of your organization to see if an Individual Coverage HRA is a good fit! Our proprietary health benefits software simplifies the process of setting up a new ICHRA plan for your organization. Our software has been designed to address each opportunity and present itself as the premium offering for employers of any size to leverage each health benefits improvement!

on the blog

Expert insights at your fingertips.

Check out our resource library for easy-to-read blogs, videos, guides to big topics, case studies, and more!