Your employees keep losing on your small business health benefits. This is not what you want to read. It is what you need to read. It’s too important to ignore.

You may have heard that 9 million small businesses are worried they’ll have to close down permanently. But employers aren’t the only ones hurting right now. As a result of poor leadership decisions, employees are hurting as well — especially when it comes to their health benefits.

Employers may be trying their best to accommodate the need for health insurance for their employees. But with annual increases from 3% to 7% over the past 20 years, there’s only so much an employer can do.

Sadly, any break in these renewal rates employers received amid Covid-19 is quickly coming to an end. Looking ahead to renewals at the end of 2021, we need to be very worried. Employers can expect a rate increase of anywhere from 10-18% increases on their traditional group plans at the end of 2021.

You may be wondering why that is, and we’ll get to that. But first, let’s examine the history of what’s been happening up to this point and why employees keep losing on small business health benefits.

1. Employees are paying more on small business health benefits.

As you know, the cost of traditional health insurance is split between the employer and the employee. The employer picks the plan and contributes a set amount towards it. Then the employee opts in to the plan and pays their portion. Group plans are about as basic and boring as it gets. Pick the plan, pay the bill, use the card.

But do you know what’s not easy? The ever-ever-ever increasing costs.

The cost of insurance has gone up more than twice that of pay increases in the past 20 years for employees. It’s like paying 2x as much and getting something 2x worse.

Why would your employee feel good about that? News flash: They don’t. And research shows they’re not participating in these benefits as much anymore as a result.

After a steady 6 year decline in uninsured Americans between 2010 and 2016, the numbers have slowly started creeping back up. This isn’t because employers are dropping plans. These stats include people who have employer-sponsored group plans but are opting out altogether.

Employees either cannot afford their employer-sponsored plans or are choosing not to “waste” their money on something that is not worth it to them.

2. Employers are dropping health insurance plans.

All small business owners know that sometimes you have to make hard decisions for the greater good of the company. One hard decision forced upon small business owners is that of health benefits.

Do I keep paying more and getting less? Do we absorb those endless increases since health benefits are so essential to employees? Or do I simply send my people away and allow them to find their insurance plans?

The data shows employers are starting to choose the latter.

Up to 36%, fewer small businesses offer health benefits compared to 20 years ago. This means employees are forced to either base their job decision on the health benefits provided or go without insurance and risk the idea of running up debt—and statistically going into bankruptcy—if anything bad happens.

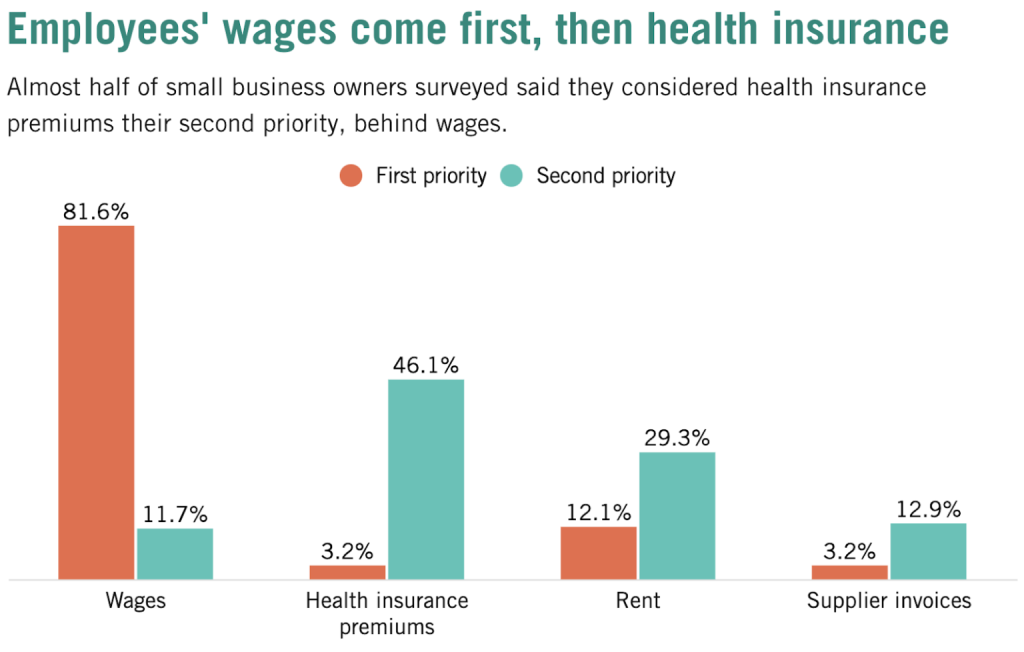

It all starts with priorities. In the graphic above from Harvard Business School, you see that only 3% of small businesses believe that health insurance is the top priority. However, 56% of employees will decide whether they will stay at their current job or seek alternative employment based on what’s being offered for health benefits. This is quite a disconnect!

To stay competitive, it’s going to take a concerted effort to rethink employee health benefits and start making it a priority for your employees. If not, your team will leave you.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

3. How to help small business employees (and employers) win.

It’s no surprise to know that health insurance for small businesses is costing employees more and many small businesses are canceling their plans altogether. Luckily, however, there’s a way to help employees and employers win.

There are more options available to small businesses than traditional group health plans. Instead of overspending on outdated models of health insurance, why not move to “managed individual” instead?

Managed individual means you give a shopping budget to each of your employees to find their own plan. Those individual plans are deeply discounted by tax credits when you cancel that old group plan!

With Remodel Health, you can help your employees find better benefits at a lower cost. That’s what we’re all about.

We want to help you rethink employee health benefits and help you to discover more options so you can care better for your employees and ultimately control your costs and quality of coverage better than you ever thought possible.

Connect with a consultant today for your risk-free Health Benefits Analysis to find the money you’ve been leaving on the table and to finally help your employees start to win with your small business health benefits.

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your professional representation to properly evaluate the information presented and its appropriate application to your particular situation.