The Inflation Reduction Act of 2022 was just passed by Congress and signed by the President. Included in this bill are profound benefits for employers as they relate to lowering healthcare costs. Specifically, the Inflation Reduction Act ensures the cost of individual health plans stays even more affordable than before. Employers should take advantage of this to lower expenses and improve coverage as a benefit to their employees.

What are individual health plans?

Individual health plans are known by many names: ACA plans, Marketplace plans, Exchange plans, Obamacare and more. But they all refer to the same thing: individual health plans. These individual health plans are offered by the same insurance companies as the group health plans that many employers offer. It’s normal health insurance, but instead of it being part of a group plan, it’s intended for individuals.

Individual health plans began with the Affordable Care Act of 2010. The ACA legislation was passed in the same way as the Social Security Act of 1935. But instead of helping Americans with retirement, it helped Americans with health insurance. The ACA provided individual health plans with a centralized location where they could be purchased, called the Marketplace.

Individual plans on the Marketplace are guaranteed-issue, which means that all preexisting conditions are covered with no exclusions or surcharges. This is made possible by the economics of each state making up its own massive risk pool. Individual state’s risk pools also explain why individual health plans are cheaper than group health plans.

Why do individual plans lower healthcare costs?

Individual plans are not only cheaper by themselves, but they are also eligible for special discounts, or subsidies. These subsidies are tax credits that lower the monthly cost of the plan even further. The exact subsidy discount amount available to individuals exists on a sliding scale that’s based on a few household factors.

Subsidies included in the Affordable Care Act were officially named Advanced Premium Tax Credits. These subsidies are instant discounts and have served to lower the cost of individual health plans for over a decade. On average, subsidies lowers healthcare costs by $8,948 per year.

How have individual health plans become even more affordable?

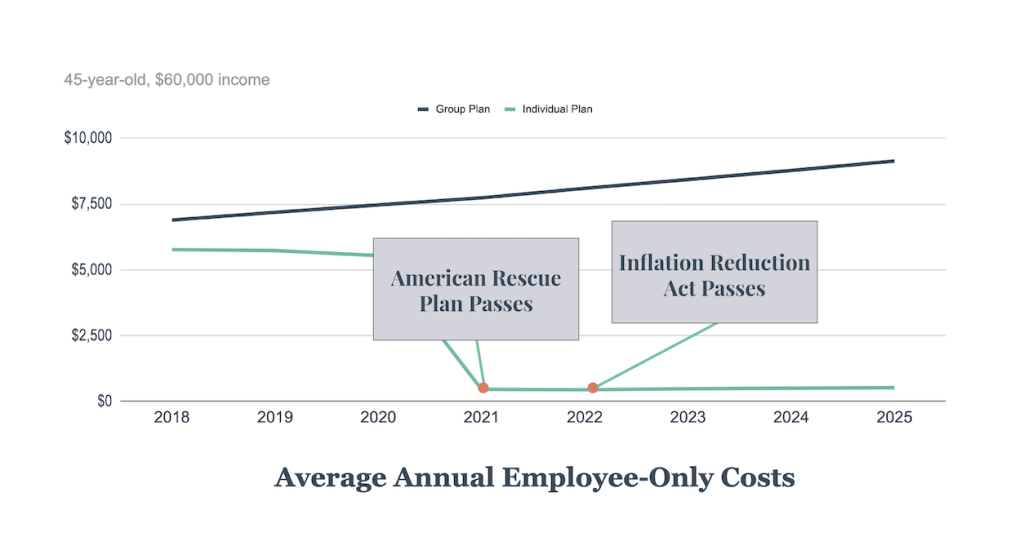

Since individual health plans had been successfully helping Americans for many years, legislation was passed for Covid-19 relief which sought to ensure even more support during the difficult times of the pandemic. In 2021, the American Rescue Plan Act enhanced those original subsidies for individual health plans and made the costs even lower than before. Individual health plans then saw record participation, which encouraged greater competition between insurance carriers and product offerings. The result was more people finding quality, affordable healthcare coverage using the Marketplace and lowering healthcare costs.

The Inflation Reduction Act of 2022 recognized and reaffirmed the success of those enhanced subsidies on individual health plans and how well they have been serving the American people by extending the original timeline from 2 years to now a minimum of 5 years. This means the incredible benefits seen by individual health plans will only continue to grow.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

Why does the Inflation Reduction Act and healthcare costs matter to employers?

The extension of enhanced subsidies on individual health plans should matter to employers because it means employers have relief when facing not only the inflation of their overhead but also the annual rate increases of their group health plans. For many years, employers have been leaving group plans for individual insurance and have seen improved benefits and drastically lower costs. In just the last 3 years, bipartisan legislation from both Republicans and Democrats have helped grow and improve this solution for employers of any size. Organizations can leave group plans and move their employees onto managed individual plans, all under one bill. By leveraging this opportunity, employers are able to provide their employees with lower deductibles and still save an average of 30-50% on their costs. This level of organizational savings is more than enough to both protect against the pain of inflation and prevent annual rate increases.

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.