The truth is, about half of consumers in the United States struggle to understand key individual health insurance terms. Words like deductible, max out-of-pocket, copay and network? These are enough to make most people either fall asleep or panic with confusion.

But it doesn’t have to be this way. I’m going to unpack the most common (and often most confusing) individual health insurance terms you need to know.

1. What is a health insurance premium?

The amount you pay for your health insurance every month. (healthcare.gov)

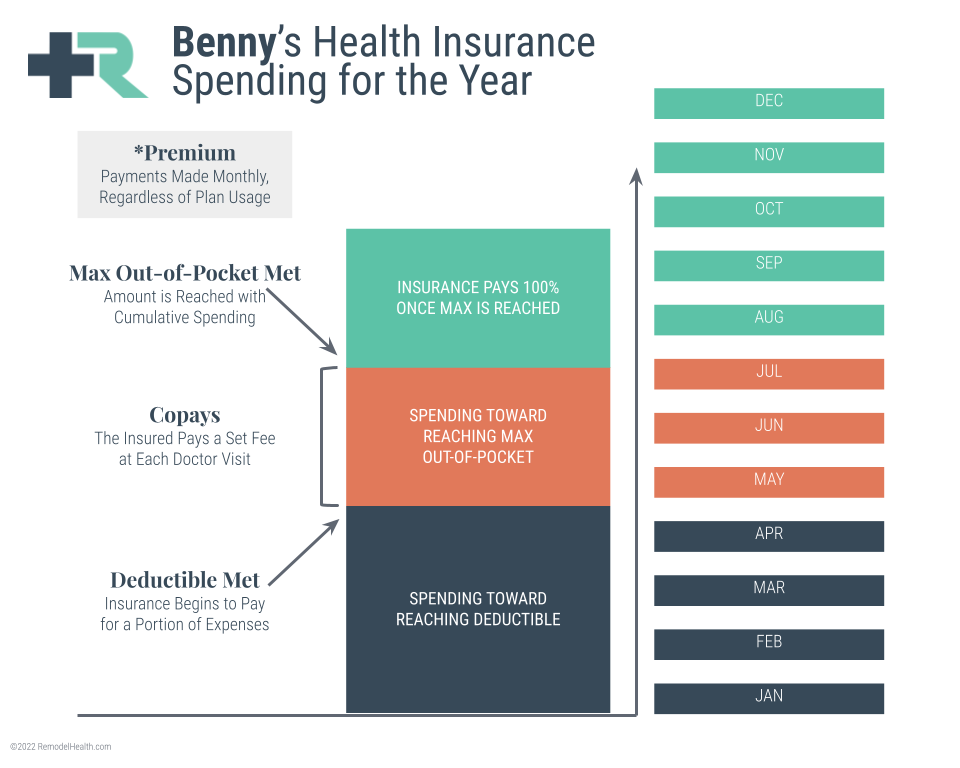

The first and most basic individual health insurance term is premium. Put simply, a premium is a monthly payment or a monthly bill that gives a person ownership of a health insurance plan. In order to purchase a health insurance plan and maintain active coverage, an individual must pay a monthly premium payment.

Adults are familiar with these types of payments (you must pay your monthly electric bill if you want to have electricity). Easy enough, right?

Paying your monthly health insurance premium gives you two things:

- ownership of a health insurance plan in your name, and

- (in most cases) coverage for preventive services (things like routine screenings and checkups).

The monthly premium is the beginning of all spending for health insurance, and must be paid even if you don’t use any healthcare services in a given month. Read on to learn how additional expenses are accrued and paid throughout the year.

2. What is a health insurance deductible?

The amount you pay for covered healthcare services before your insurance plan starts to pay. (healthcare.gov)

The next individual health insurance term I’ll unpack is deductible. A deductible is a set amount of money that a person is responsible for paying in a given year before health insurance “kicks in.” For example, if your health insurance plan has a deductible of $5,000, you are responsible for paying for all healthcare services (bills from doctor visits, procedures, etc.) on your own until your spending reaches a total of $5,000. Once your deductible has been met, the health insurance company will begin to pay for additional healthcare expenses.

It’s not quite that simple, though!

Depending on your health insurance plan, simply reaching your yearly deductible does not automatically mean all healthcare expenses will be covered by insurance for the remainder of the year. In many cases, reaching the deductible is just one of several boxes that must be checked in order for the health insurance plan to fully begin paying 100% of your healthcare expenses. Checking all of the boxes (or paying all of the things) will eventually cause you to reach your max out-of-pocket. And that is when your health insurance plan will begin paying for 100% of your covered healthcare services.

We’ll get to max out-of-pockets a little later. For now, let’s talk about copays.

3. What is a health insurance copay?

A fixed amount you pay for a covered healthcare service. (healthcare.gov)

A copay (short for copayment) is a fixed amount of money that you pay each time you go to the doctor or fill a prescription. Not all health insurance plans have copays, and quite honestly they can be a little tricky to understand.

The main reasons people like copays are:

- they help keep monthly premium payments low (plans with higher copays typically have lower monthly premium costs), and

- they are convenient (for example, it’s much easier to plan for medical bills if you know you’ll only have to pay a $30 copay each time you visit the doctor’s office).

Copays vary in that they sometimes count toward meeting the yearly deductible, and they sometimes do not. However, copayments will always count toward reaching your max out-of-pocket. (Remember, many things combined can add up to meet the max out-of-pocket).

Which brings me to my next point…

4. What is a health insurance max out-of-pocket?

The most you have to pay for covered healthcare services in a year. (healthcare.gov)

Max out-of-pocket might be the most misunderstood individual health insurance term there is. I want to clarify right away that a max out-of-pocket is not the same as a deductible.

I repeat: a max out-of-pocket is not the same as a deductible.

A max out-of-pocket (also referred to as an out-of-pocket limit) is the most a person will ever have to pay for covered healthcare services within the health insurance plan year. You can meet this max out-of-pocket amount in a combination of ways: by paying for services that count toward meeting your deductible, paying copays, and more. Note that your monthly premium payment does not count toward reaching your max out-of-pocket.

Again, once you reach your max out-of-pocket amount, your health insurance plan is then responsible for paying 100% of your covered healthcare expenses for the remainder of the plan year.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

5. What is a health insurance network?

The facilities, providers and suppliers your health insurer or plan has contracted to provide healthcare services. (healthcare.gov)

In a nutshell, a health insurance network is the group of hospitals, doctors, pharmacies and other healthcare facilities that have signed a service contract with a health insurance company. The purpose of this contract is to make billing for services easy for the insured and the insurer. It’s always a good idea to familiarize yourself with the list of healthcare providers in your health insurance network, because you’ll usually receive a discount on services at these locations.

6. How do I know if I have a “good” health insurance plan?

These individual health insurance terms work together to form many different types of plans. (healthcare.gov)

You now understand the difference between the individual health insurance terms premium, deductible, max out-of-pocket, copay and network, and how they function together to form health insurance plans. The question you’re probably wondering now is, “how do I know if I have a ‘good’ health insurance plan?” The answer to this question will be different for everyone.

Let’s outline some comparisons:

- Generally, plans with lower monthly premiums will have higher deductibles (and vice versa). These plans are ideal for people who are in good health and do not require lots of healthcare services.

- Conversely, people who do require more medical care may find themselves better suited to a health insurance plan with a high monthly premium and a lower deductible. This method could save a lot of money in the long run.

- As mentioned before, plans with higher copays will have lower monthly premiums. Copay plans are ideal for people who want the convenience of consistent, easy payments at each doctor’s visit.

When deciding on the best health insurance plan for you, it’s also a good idea to check out the plan’s network. Certain plans will cost more if you visit an out-of-network provider.

In summary, a “good” health insurance plan is what works best for you and your unique health and financial situation. Understanding these key individual health insurance terms will ensure you have the knowledge you need to make a well-informed decision!

In our next blog, we’ll answer the question “what is individual health insurance?” Thanks for taking the time to learn more about Individual Health Insurance Terms 101!

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.