Small Businesses Should Cancel Group Health Plans

By Remodel Health Team on May 13, 2021 9:32:00 AM

Yes, you read that title right: small businesses should cancel group health plans immediately!

Before you click away or stop reading, hear me out. I didn’t say you should not provide any health benefits, I said to cancel your group health plans.

“Wait—aren’t those the same thing?” Answer: no. But if you thought they were, you’re not alone in that misconception!

So what is a group health plan?

A traditional group health plan is when the employer works with a broker to select a health insurance product to offer to their entire eligible staff, and also pays at least a portion of the cost.

I’m here to tell you there is a better option than those outdated, overpriced, underused group health plans. Let’s have a look at why small business owners should start opting out of their traditional group plans.

1. Traditional Group Plans Cost Too Much

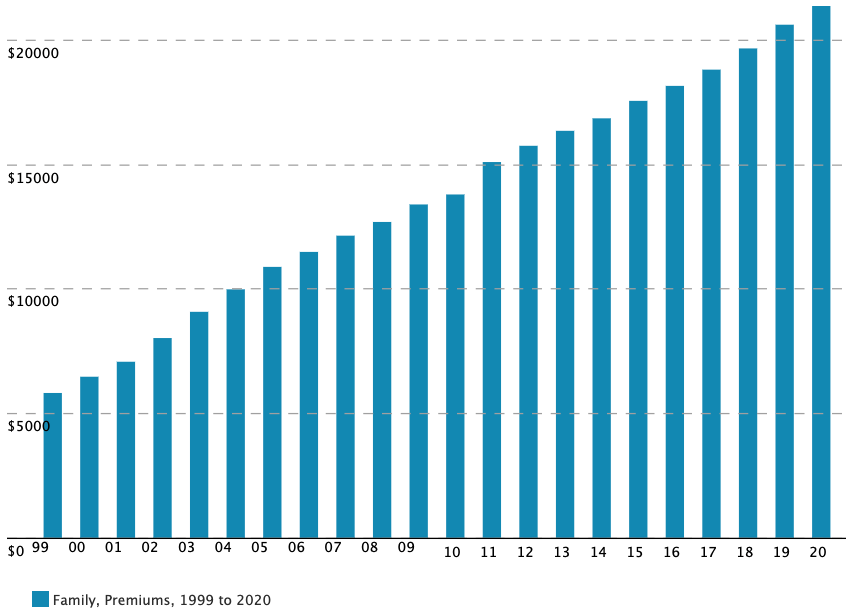

If you take a look back over the past two decades, it’s no surprise that we pay so much for traditional group health insurance. The Kaiser Family Foundation started tracking this data in 1999 and one quick look at the trendline reveals that these steep prices have been a long time coming.

We would never keep paying more for getting less in any other area of our business, so why do we continue to do it with our health benefits?

It’s most likely because we feel stuck. We know it is important to offer health benefits to employees, but we don’t know what our other options are. Our lack of knowledge and fear of the unknown continues to drive us to leadership paralysis.

2. You’re Also Missing Out on Discounts

Did you know that there are “discounts” available for name-brand health insurance plans? And no, these are not Kohl’s discounts, where everything is just marked up in order to mark it down with a discount. These are real discounts on real health insurance — called Advanced Premium Tax Credits — that are only available once employers cancel their traditional group health plan.

If you are not leveraging these discounts, it means that you are leaving money on the table.

At a very high-level, these subsidies work by imposing a spend limit on what percentage of household income a person will pay for the benchmark insurance plan. If the plan costs more than that limit (which it nearly always does), a tax credit is sent directly to the insurance company from the IRS to discount the cost of their product.

Also note: while subsidy calculation uses the benchmark insurance plan, the actual tax credit can apply toward any Individual Marketplace plan.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

These discounts have been around since 2015. But the American Rescue Plan Act (ARPA)—also known as the $1,400 stimulus bill that passed in early 2021—ushered in a major change to the way these subsidies were distributed to U.S. citizens. Because of the ARPA, the spend limit has decreased in half (see table above). Which means people are now paying half of what they paid before.

Small businesses can take advantage of these discounts for their team. But the only way to do that is to cancel group health plans and move into the “managed individual” model.

Don’t know what that is yet? Don’t worry, we can help with that!

Managed Individual Health Benefits for Small Businesses

Remodel Health has been serving small businesses transition out of their traditional group plans and into the managed individual model for 6 years now. On average, small businesses save 30-50% on their health insurance costs as a result. What could you do with those savings?

With the help of Remodel Health, you can spend smarter and make your benefits better.

Connect with a Benefits Consultant today for a risk-free analysis of all your options. Sticking to your traditional group benefits has gotten you to where you are now. Finding your next step for your small business is the key to turning the corner and finally making an impact on health benefits for your employees.

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends to consult with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.

Check out more resources

See these related articles

Cheapest Alternative Health Benefits for Private Schools

Take advantage of the cheapest alternative health benefits for private schools to see significant savings and care better for your team!

Who is Eligible for Individual Health Insurance?

Wondering who's eligible for individual health insurance? Check out Remodel Health's latest blog to discover if you're an ideal candidate.

Wage Increases vs. Health Benefits

The “wage increase” model is a successful solution for employee health benefits. Learn more about providing wage increases as an employer!