Remodel Health recently released its 2023 National Health Benefits Analysis (NHBA), a deep-dive into reshaping employee health benefits. Here, you will find a breakdown of this report.

What is the NHBA Report?

The National Health Benefits Analysis (NHBA) is an extensive annual report that analyzes statistics and proprietary data researched by Remodel Health. This year, our NHBA examines the shift from traditional group health insurance to individual health insurance.

This blog will guide you through consolidated content sections based on the different sections of the 2023 NHBA.

1. The Managed Individual Method

The success of Qualified Small Employer Health Reimbursement Arrangements (QSEHRAs) is what signified that there is value in the managed individual health insurance model for workforces. When Individual Coverage Health Reimbursement Arrangements (ICHRAs) emerged in 2020, employers quickly realized the significant and beneficial shift in the insurance delivery model. ICHRAs have taken the concept of allocating an employer’s budget for their employees’ health needs and further refined this approach.

2. Applicable Large Employers (ALEs) and ICHRAs

Applicable Large Employers (ALEs) have grown exponentially and will continue doing so. ALEs have a mandate from the Affordable Care Act (ACA) that requires participation in their employees’ health insurance. QSEHRAs do not fulfill the mandate, which is why ICHRAs are so powerful. ICHRAs offer a new, structured method for ALEs to satisfy the mandate, evident in the staggering 144% year-over-year increase in ALEs participating in ICHRAs. The surge in ALEs utilizing ICHRAs indicates it’s a win for all parties.

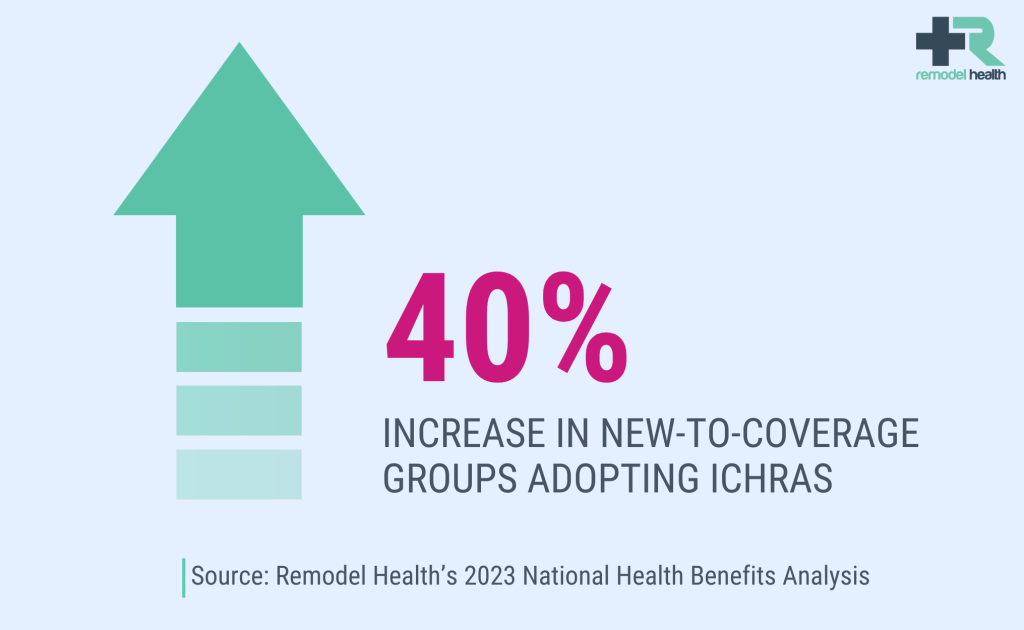

3. New-to-Coverage Groups and ICHRAs

New-to-coverage groups are employers who have not formally offered health insurance or have halted their offerings due to the skyrocketing cost of traditional group health insurance. These groups witnessed a 40% year-over-year increase in the adoption of ICHRAs. This occurred partly because ICHRAs represent an optimal entry point for employers to initiate health benefits. ICHRAs are leveling the playing field, evident in the 40% uptick in new-to-coverage groups. Employers previously unable to offer health benefits now can.

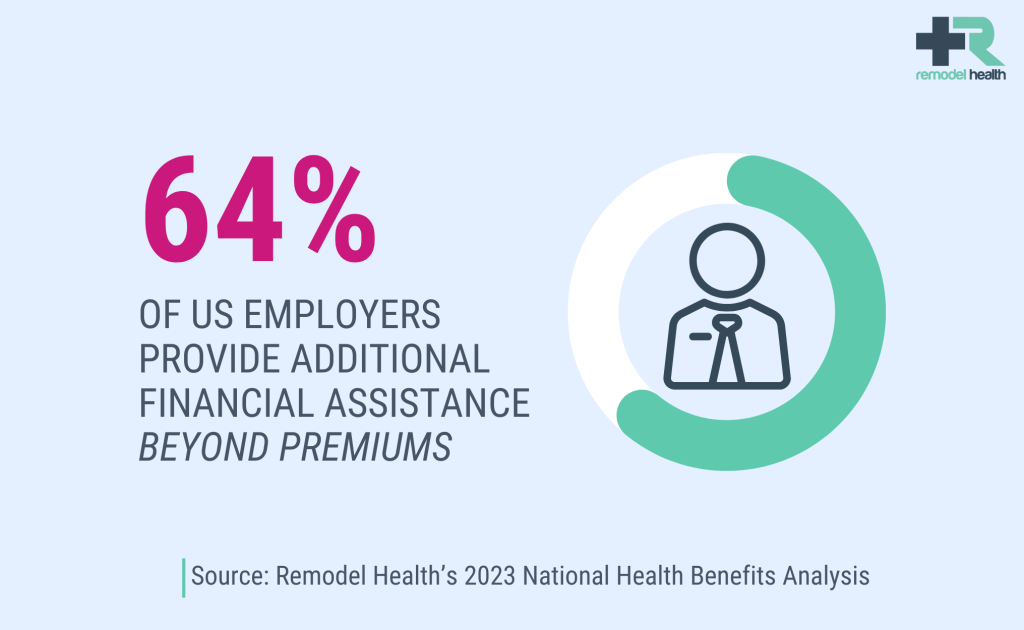

4. Going Beyond the Insurance Premium with ICHRAs

Data shows that simply assisting employees with insurance plans and premiums isn’t enough. Medical bills that accrue with insurance coverage are the pain points employers must tackle to remain competitive. This is where ICHRAs come into play. ICHRA funds can not only cover monthly insurance premiums but can also be used for medical bill reimbursements. About 64% of U.S. employers provide additional financial assistance beyond premiums. ICHRAs enable employers to offer better plans and superior coverage levels.

5. The Economic Landscape of Employee Health Benefits

The ever-evolving world of health benefits has witnessed notable financial shifts, particularly when contrasting traditional group health plans with individual ones. These shifts hold significant ramifications for employers, guiding their strategic choices in health benefits offerings. As of June 2023, benefits comprise an impressive 29.4% of total compensation for employees in private sectors. This revelation speaks volumes about the considerable financial burden employers undertake, extending beyond just salaries. As employers navigate this complex landscape, understanding these financial trends becomes paramount.

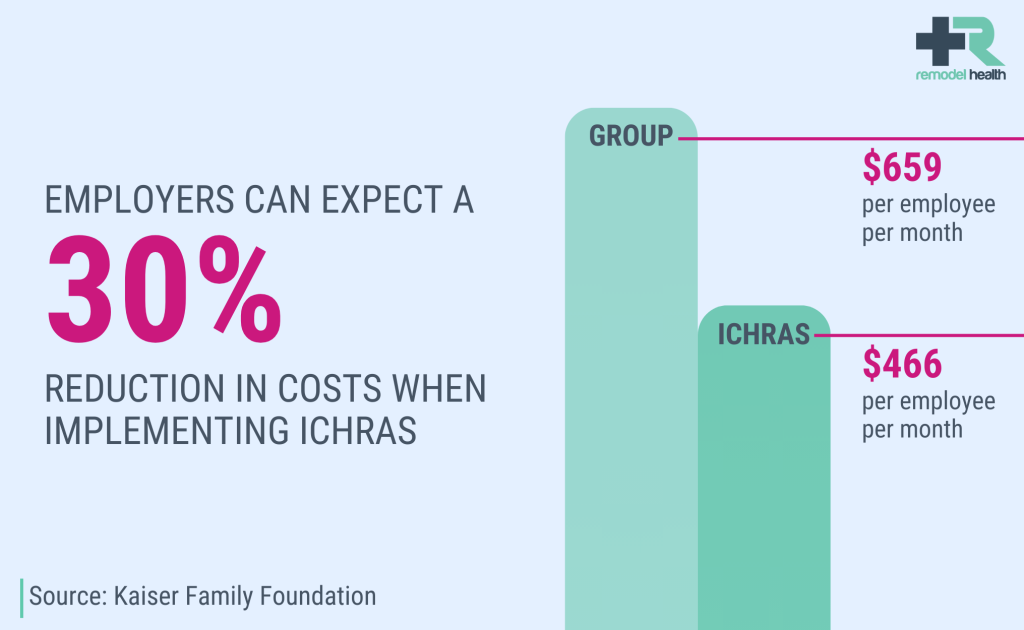

6. Cost-Effective Employer Contributions

Employers nationwide are concerned about the cost of providing health benefits to their workforce. With ICHRAs, employers can expect a striking 30% reduction in costs to employers. It’s important to note that being economical does not signify compromising quality, especially with a well-structured health benefits delivery strategy. Imagine delivering the same foundational coverage at a third of the cost. The amassed savings can be channeled into medical bill reimbursement, presenting a dual advantage. The narrative is straightforward: efficient health benefit strategies can be both economical and superior in quality.

7. The Crucial Role of Education and Support

Venturing into new territories, such as business operations or employee benefits, comes with its challenges. The introduction of a different health benefits approach is no exception. Before diving into the solutions, it’s essential to emphasize the significance of this change. ICHRAs bring about a monumental impact. The advantages they offer—from cost savings to tailored coverage options—are undeniably worth the shift.

Why Work With Remodel Health?

Since 2015, Remodel Health has revolutionized how health benefits are delivered to employees. Our mission is to revolutionize health benefits to resource organizations with missions that matter. Our professional team is focused on providing affordable and personalized plans, dedicated to helping employers deliver better benefits while saving money, and passionate about making it easier than ever to enjoy high-quality healthcare plans.

Reach Out to Remodel Health Today

Every year, we make it our mission to assemble a report that provides a statistical analysis of proprietary data researched by Remodel Health. Individual health insurance plans have evolved and will continue to evolve. Remodel Health seeks to remain at the forefront of that evolution.