guides & resources

Individual Coverage HRA Guide

Here’s everything employers, brokers, and HR professionals need to know about providing an ICHRA to employees.

Overview

What is an Individual Coverage HRA?

Since its establishment in January 2020, this innovative health benefits solution has replaced the traditional health benefits model for millions of organizations nationwide.

Overview: What is an ICHRA?

Reimburse employees tax-free for qualified medical expenses.

An Individual Coverage HRA, or ICHRA, is an employer-funded Health Reimbursement Arrangement (HRA) in which employers of any size or industry can reimburse employees tax-free for qualified medical expenses.

ICHRA rules allow an employer of any size to use pre-tax dollars to reimburse employees for healthcare costs instead of buying it for them upfront. This innovative health benefits solution has been replacing the traditional health benefits model for millions of organizations nationwide since January 2020, when it was established.

quick history of individual Coverage HRA.

Background on HRAs.

The HRA model of distributing tax-free medical dollars to your staff with (near) simplicity has been around for a while. Previously, though, strict rules have limited many employers from taking advantage of this innovative model.

HRAs (Health Reimbursement Arrangements) started in 1974 with the ERISA Act, aiming to slow down rising medical costs. The new law allowed employers to offer employees tax-free reimbursements for healthcare expenses. Unfortunately, it did not succeed in stopping the ever-increasing price of healthcare.

By the time the 2000s arrived, the IRS had offered some updates that allowed HRAs to shine. The changes improved employers’ flexibility in determining different reimbursement amounts for employees across their organization. Those funds could then be used toward both medical expenses and premiums.

The problem was that while the updates improved employers’ budgets, they did not improve employees’ access to and affordability of healthcare. Thus, the Affordable Care Act (ACA) was introduced in 2013. This, however, was not good news for the HRA.

The ACA introduced new definitions and requirements for health insurance plans. HRAs fell under this new definition of a “plan” and became subject to the requirement of providing Essential Health Benefits and having no Lifetime Limit.

HRAs were then considered incompliant unless “integrated” with a fully insured ACA-compliant group plan.

Background on previous HRA limits.

While the ACA improved access to medical coverage through the Individual Marketplace, its disruption to the industry increased costs for group healthcare even more—especially for companies with under 50 employees.

To give employers an alternative to canceling plans they could no longer afford, Congress enacted the 21st Century Cures Act in 2016, which included the provision for Qualified Small Employer HRAs (QSEHRA). It allowed small employers to offer dollars to their employees to spend on individual plans.

However, the strict limits on employer size and reimbursement amounts significantly limited QSEHRA’s application pool. Large employers could not use QSEHRA; the allowances were too small, and offering it offset premium tax credits for employees.

To address these problems, the Trump Administration released an Executive Order in mid-2019 outlining new rules for HRAs. The goal was to increase flexibility for employers and employees to better utilize the Individual Marketplace. Starting in 2020, Individual Coverage HRAs (ICHRA) have been available.

How ICHRA is different.

New ICHRA rules allow an employer of any size to use pre-tax dollars (as opposed to the QSEHRA). They must be used in tandem with an ACA-compliant plan, but an employee can use those dollars to pay for their premiums plus qualified medical expenses. More importantly, if the ICHRA allowance is considered IRS unaffordable, the employee may opt out and use Premium Tax Credits instead.

There are certainly incentives to allow for increased diversity in healthcare spending, which will inevitably increase market competition (which either makes products better or drives prices down). The organization sets its budget, and the employee gets better customization on how their dollars will be spent. This ruling is certainly a great addition to the menu of innovative options developed over the past few years.

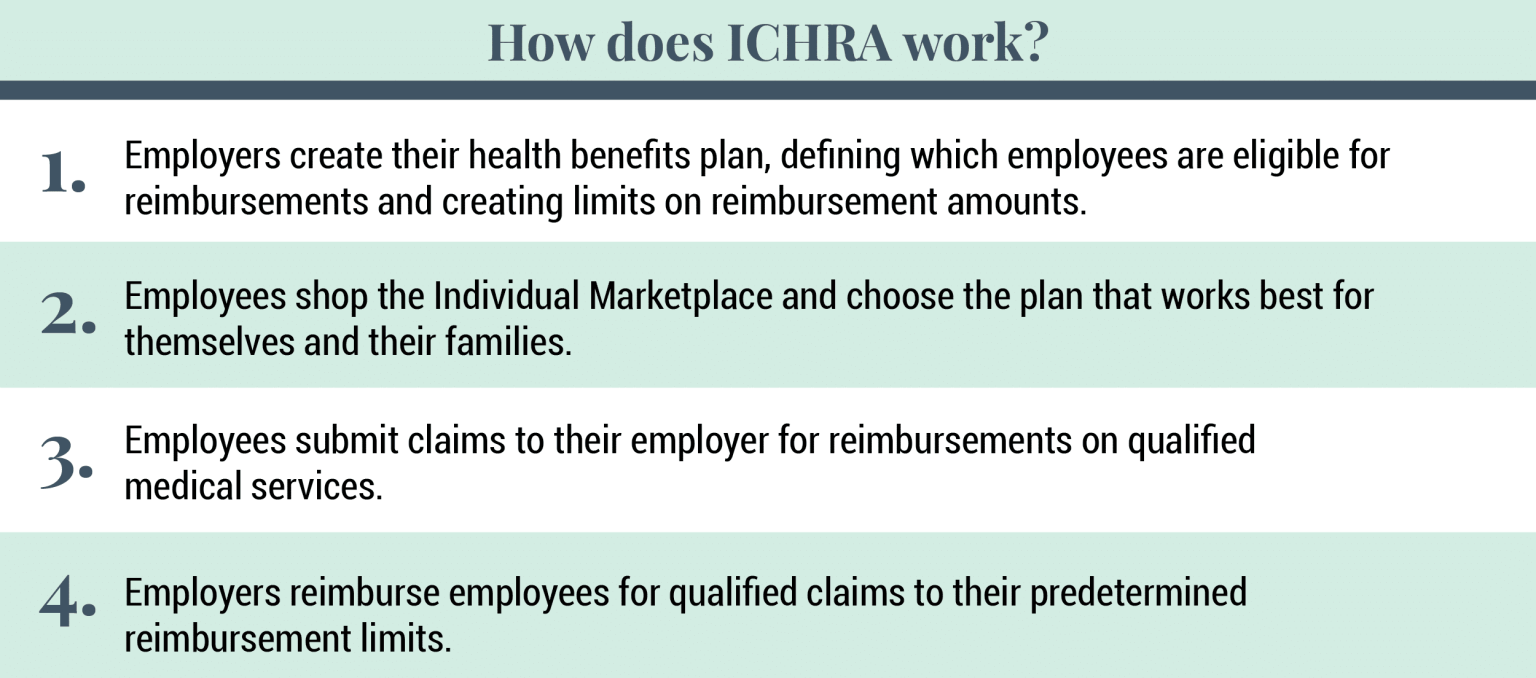

The Rules: How Does ICHRA Work?

Reimburse for healthcare costs instead of buying a plan upfront.

ICHRA rules allow employers of any size to use pre-tax dollars to reimburse employees for healthcare costs instead of buying it for them upfront. These tax-free dollars must be used with an ACA-compliant plan, but employees can use those dollars to pay for their premiums and qualified medical expenses.

However, employees receiving subsidies, such as Premium Tax Credits, will be directly affected by ICHRA. If an employee accepts the ICHRA, they are no longer eligible for Premium Tax Credits because ICHRA is considered a form of minimum essential coverage.

Employees can opt out of ICHRA and retain their Premium Tax Credits if the ICHRA is deemed unaffordable under IRS guidelines. Therefore, employers must clearly communicate the impact on subsidies to help employees make informed decisions.

Valuable methods for setting up an ICHRA.

First, employers must apply these HRA dollars equally to everyone within any given class of employees (the class right now is up for interpretation). However, some useful methods of classifying employees (when consulting with an expert) can provide a more personalized experience in caring for your team.

Second, you cannot double-dip. You can pick either the HRA allowance or your Premium Tax Credit. You cannot use both. By opting into the HRA, you immediately lose your tax credits, which often is a better deal than using an HRA.

Third, while Applicable Large Employers (ALEs) can use ICHRA, it does not necessarily fulfill the employer-shared responsibility (also known as the “mandate”). If the ICHRA allowance for that individual is considered an affordable plan, then the mandate is fulfilled. If not, then either part A or part B of the shared responsibility will be billed to you by the IRS.

Unique features of ICHRA.

One of the best aspects of the new ICHRA is its flexibility and employer-friendly nature. Below are some of ICHRA’s unique features:

- Employers of any size can use ICHRA

- ICHRA fulfills the large employer mandate

- Reimbursements can be used for medical expenses and premiums

- Reimbursement amounts are unlimited

- Employees can be organized into groups with custom allowance amounts

- Allowances do not offset premium tax credits

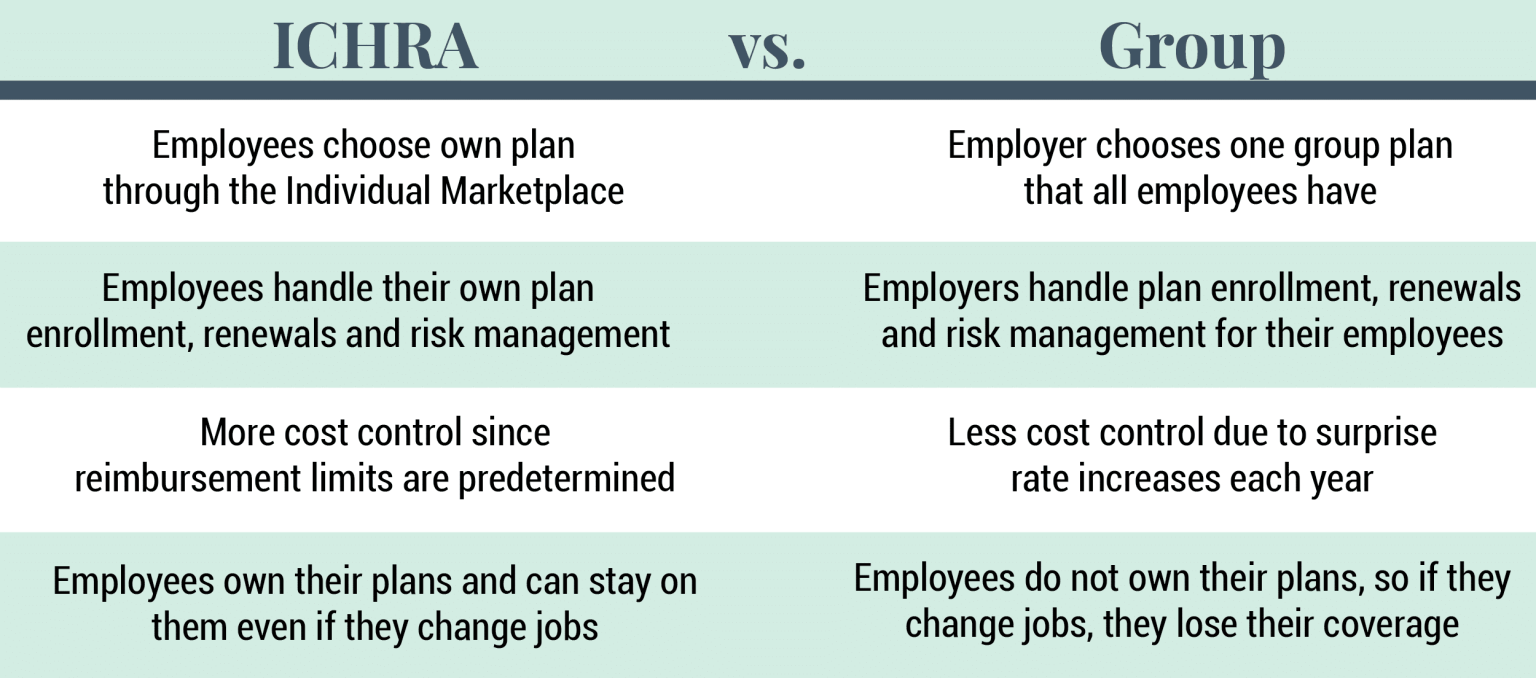

ICHRA vs. Group plans

Control the cost of health benefits with more accuracy.

Many employers are intrigued by the new ICHRA for several good reasons. For one, using a reimbursement strategy allows employers to control the costs of their health benefits with much more accuracy. Plus, the Individual Marketplace allows employees to shop for a plan that suits their unique needs rather than getting put on a one-size-fits-all group plan. This means employees receive a health benefit that better meets their needs.

Opting for an ICHRA also means employers don’t have to worry about micro-managing their employees’ healthcare. It also takes the pressure off choosing a group plan that meets the far-and-wide medical needs of their employees — especially a benefit for large employers that could not qualify for QSEHRA previously.

Employees with ICHRAs choose their own plans, handle their own renewals, choose their own doctors, and submit their own reimbursement requests. The employer simply determines which employees qualify and how much they will reimburse for qualified medical expenses.

How To get started with an iCHRA.

Software that helps you design your new ICHRA plan.

Are you ready to get started with an ICHRA? Run a no-risk analysis of your organization to see if an Individual Coverage HRA is a good fit for your organization!

Remodel Health’s proprietary health benefits software simplifies the process of setting up a new ICHRA plan for your organization! Our software has been designed to address each opportunity and present itself as the premium offering for employers of any size to leverage each next improvement to health benefits. With the help of our software, you can:

Design & Compare: Discover equivalent coverage to your old group plan, review exact prices, and design budget strategies across multiple options to lower your team’s risk and save on topline costs.

Tax Calculations: Ensure all tax situations for individuals and the employer are evaluated through our proprietary algorithm; payroll taxes, large employer shared responsibility payments, and more are handled.

Shopping & Enrollment: Enjoy a curated shopping experience that guides each employee to the exact plan that best fits their specific needs.

Autopay & Group Bill: Monthly premiums are handled automatically by payroll deduction and one group bill, so you unlock the power of individual plans with all the convenience of being organized as a group.

Online Portal: Plan documents, training videos, contact details, and digital insurance cards, all digitally available.

Year-Round Support: You no longer have to answer every question from your staff and their families. Instead, provide them with licensed personal support to get answers for their plans when they need them.

Benefits of ICHRA for Employees

An individual coverage HRA offers employees significant benefits such as:

Personalized Health Coverage

With ICHRA insurance, employees can select plans that best fit their needs, unlike a traditional group health plan. This choice leads to higher satisfaction and retention, as employees feel more valued and in control of their health coverage.

Financial Savings

Employees enjoy tax-free reimbursements, which can lead to substantial savings. For example, ICHRA can reduce out-of-pocket costs compared to a traditional group health plan, making health insurance more affordable.

Setting Up an ICHRA Plan

Setting up an ICHRA for your organization can be straightforward. Follow these steps to get started:

- Determine Eligibility: Define which employee classes will receive the benefit.

- Set Reimbursement Limits: Decide how much to reimburse for individual health insurance premiums.

- Select Start Date: Choose when the ICHRA plan will begin.

- Communicate with Employees: Inform them about the new ICHRA and how it works.

- Implement and Manage: Use a software solution like Remodel Health’s ICHRA+ product to handle administration.

To ensure compliance and efficiency, consult with legal advisors and use reliable tools to manage your plan.

Tools And Software

Solutions simplify ICHRA administration by automating reimbursements, reporting, and compliance tasks. These platforms also offer analytics and dashboards that help track spending and employee usage patterns.

RemodelHealth’s ICHRA+ product has built-in regulatory updates to enable employers to stay compliant while minimizing the administrative burden. This enables employers to enjoy smooth and efficient management of individual coverage health reimbursement plans.

Compliance and Legal Considerations

To ensure compliance with IRS guidelines, employers must follow several key rules for ICHRA, which include:

- Establish clear eligibility criteria for employee participation.

- Ensure consistent reimbursement amounts within employee classes.

- Maintain documentation for all reimbursements, including receipts and proof of insurance.

- Conduct regular audits to stay updated with federal laws and regulations.

- Communicate guidelines and compliance requirements clearly to all employees.

- Confirm that ICHRA allowances align with IRS affordability thresholds to avoid penalties.

- Provide options for employees to opt out if the ICHRA is deemed unaffordable under IRS rules.

Integration with ACA Requirements

ICHRA aligns with ACA compliance by allowing employees to purchase individual health insurance plans that meet ACA standards. To avoid common challenges, employers should verify that their plans are ACA-compliant and provide options for employees to opt-out if the ICHRA is deemed unaffordable, ensuring seamless integration with ACA regulations.

ICHRA vs. Other HRAs

When choosing a Health Reimbursement Arrangement (HRA), understanding the differences between options is essential for small businesses. ICHRA, QSEHRA, and EBHRA each have unique benefits and drawbacks that can affect employees’ health coverage and overall plan effectiveness.

|

Feature

|

ICHRA

|

QSEHRA (Qualified Small Employer HRA)

|

EBHRA (Excepted Benefit HRA)

|

|---|---|---|---|

|

Pros

|

Flexible health insurance coverage for any employer size |

Designed for small businesses with fewer than 50 employees |

Covers limited benefits, such as dental or vision, without a major medical plan. |

|

Cons

|

Requires ACA-compliant plans; can be complex to administer. |

Limited reimbursement amounts and only for small employers. |

Does not cover comprehensive health insurance coverage. |

|

Best Fit

|

Businesses of any size seeking customizable health benefits. |

Small businesses wanting a straightforward, low-cost option. |

Employers offering supplemental benefits to enhance existing plans. |

Frequently Asked Questions (FAQs)

Common Queries from Employers

- What are the tax benefits of offering an ICHRA?

ICHRA allows for tax-free reimbursements, reducing both employer and employee tax liabilities. - Can an ICHRA fulfill ACA requirements for large employers?

Yes, but only if the ICHRA allowance meets IRS affordability thresholds for employees. - How do I determine the reimbursement amounts for employees?

Reimbursement amounts can be set based on employee classes and adjusted for budget flexibility. - Is there a minimum or maximum contribution limit for ICHRA?

No, there are no federal limits. This allows for customized contribution strategies.

Common Queries from Employees

- Can I use ICHRA funds for any health expenses?

ICHRA funds can be used for eligible medical expenses and individual health insurance premiums. - What happens if the ICHRA plan is unaffordable for me?

If deemed unaffordable, you can opt out and use Premium Tax Credits instead. - Do I have to choose a specific health insurance plan?

You must select an ACA-compliant plan to use ICHRA reimbursements effectively. - Will my ICHRA reimbursements affect my tax credits?

Yes, opting for ICHRA means forgoing Premium Tax Credits for health coverage.

on the blog

Expert insights at your fingertips.

Check out our resource library for easy-to-read blogs, videos, guides to big topics, case studies, and more!