If you want to retain and recruit quality employees and clients, you’ll need to offer competitive benefits—it’s a no-brainer. The easiest way to do that? Offering ICHRAs. Now, if you don’t know what an ICHRA is, don’t worry. You aren’t actually a dummy. We’ve created a comprehensive “ICHRA for Dummies” guide to help simplify and streamline the basics of the elusive ICHRA.

What Does ICHRA Stand For?

ICHRA stands for Individual Coverage Health Reimbursement Arrangement.

ICHRA Definition

An Individual Coverage HRA, or an ICHRA (pronounced “ick-ruh”), is an employer-funded Health Reimbursement Arrangement (HRA) that increases flexibility for both employers and employees to utilize the Individual Marketplace better. This HRA allows employers of any size or industry to reimburse employees tax-free for qualified medical expenses.

Basically, ICHRAs are the next best thing—and they’ve actually been around since 2020! But there was also a lot going on that year, so if you’re just now hearing about ICHRAs, that’s okay.

Why is ICHRA Important?

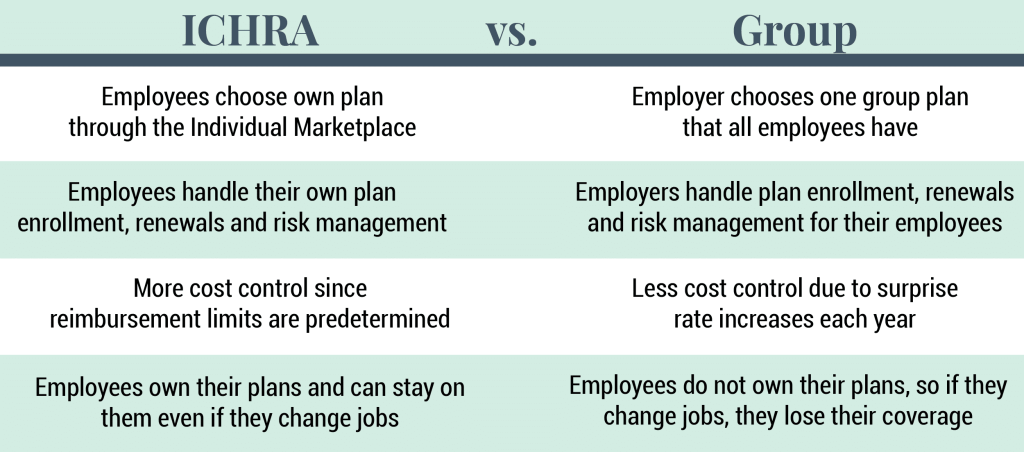

ICHRAs are important because they give both employers and employees more control and flexibility over health benefits. Not only are they flexible, but they’re different from traditional approaches—in all the best ways. Where traditional approaches are lacking, ICHRAs are abundant.

How Do ICHRAs Work?

Here’s a breakdown of the simple steps:

- Employers put money into employees’ ICHRA accounts, like a bonus for your health.

- Employees choose an insurance plan that suits them, and employers pay the monthly bill up to a certain amount.

- Employees can use funds for eligible healthcare costs and should keep receipts handy!

What Are Some ICHRA Benefits?

- Empowerment and Choice – Employees can choose the health insurance that meets their unique needs.

- Tax Benefits – Save on taxes! The money provided through ICHRAs isn’t subject to payroll or income tax.

- Budget-Friendly – Companies can decide how much they want to contribute, giving them control over their healthcare budget. No more surprises!

- Flexibility and Scalability – ICHRAs can be tailored to an organization’s size and needs.

- Attract and Retain Talent – Increase your company’s appeal to current and prospective employees.

What Are Some ICHRA Rules?

- Participants must have an Individual Policy to receive reimbursements.

- Employees are required to receive an Initial Notice in advance.

- Participants must prove that they are enrolling in an individual policy before employer contributions can be distributed. Employers must verify employee’s coverage status.

- Employers can limit ICHRA eligibility to certain classes.

- The ICHRA must be defined within a formal document. HRA administrators must define the plan within a document accessible to employees and their dependents.

- An ICHRA is a Self-Funded Group Health Plan and is subject to ERISA and IRS rules.

Where Did ICHRA Come From?

ICHRA made its grand entrance in 2020, but its story began a few years earlier. The groundwork was laid in 2017 when an executive order from the U.S. government aimed to increase healthcare choices for workers and employers. This directive led to the development of ICHRA, offering a new way for businesses to provide health coverage without sticking to the one-size-fits-all approach of group health insurance.

ICHRA came to life officially in 2019 through regulations issued by the Departments of Health and Human Services (HHS), Labor (DOL), and Treasury. It was designed to empower employers with more flexibility in reimbursing employees for individual health insurance premiums and other qualified medical expenses.

Since its inception, ICHRA has evolved by expanding the types of expenses it can cover and allowing more customization for businesses of all sizes. It’s a dynamic, ever-adapting option that’s shaking up the world of employee health benefits, giving companies the power to craft health coverage that truly fits their unique needs.

Customizing ICHRA for Your Business

Thinking about how to make ICHRA work for your business? You’re in luck!

One of the best things about an ICHRA plan is that it’s not a one-size-fits-all deal. It’s more like a customizable health benefits buffet—designed to fit the unique needs of your team. Let’s dig into how you can tailor it just right for your company.

First up is class-based eligibility. ICHRA allows you to create different “classes” of employees based on criteria like full-time, part-time, seasonal, or even by location. This means you can offer different company-funded health benefits to different groups, giving you the flexibility to provide exactly what each group needs.

Got remote workers? No problem—they can be in a class of their own!

But how do you decide how much to contribute to each employee’s ICHRA account? A good strategy is to consider factors like the employee’s role, location, or market standards for health benefits.

Some businesses opt to base contributions on employee tenure or job level. You could even benchmark against what your competitors are offering. The key is to find a balance that works for your budget while keeping your employees happy and covered.

Contact Your #1 ICHRA Provider Today

If you’re ready to learn even more about ICHRAs, our health benefits experts are here to help. Remodel Health is the #1 ICHRA Provider, so you can rest assured you’re in qualified and capable hands regarding ICHRA administration. For a more detailed breakdown of all things ICHRA, check out our ICHRA 101 Guide.