Individual health insurance is personal. And individuals’ personal preferences guide their decisions every day. This is especially true when people are given the opportunity to choose their own health benefits!

Offering a traditional group plan to employees, however, eliminates personal choice from one of the most important things people receive: health insurance. This one-size-never-fits-all plan is expected to satisfy the unique needs of many employees, but it’s nearly impossible to make everyone happy with one plan. So, the question remains — why are employers still providing traditional group health insurance?

The answer to this question is explained through employers not realizing they have options beyond the traditional group plan. In fact, one option that has been growing in popularity over the past decade is a solution we call “managed individual.” Essentially, this model of health benefits allows employers to provide their employees an extra wage to then choose and purchase their own individual plans. It’s really a win-win, because employers save money and individuals get to select individual health insurance plans to meet their needs!

Making the switch to individual health insurance plans that improve your team’s benefits package is easier than you think. But you may be wondering what your employees would do when given the option to choose their own plans. Today, we’re going to unpack the most popular individual health insurance choices that employees actually want!

What Type of Individual Health Insurance Plans Do Employees Want?

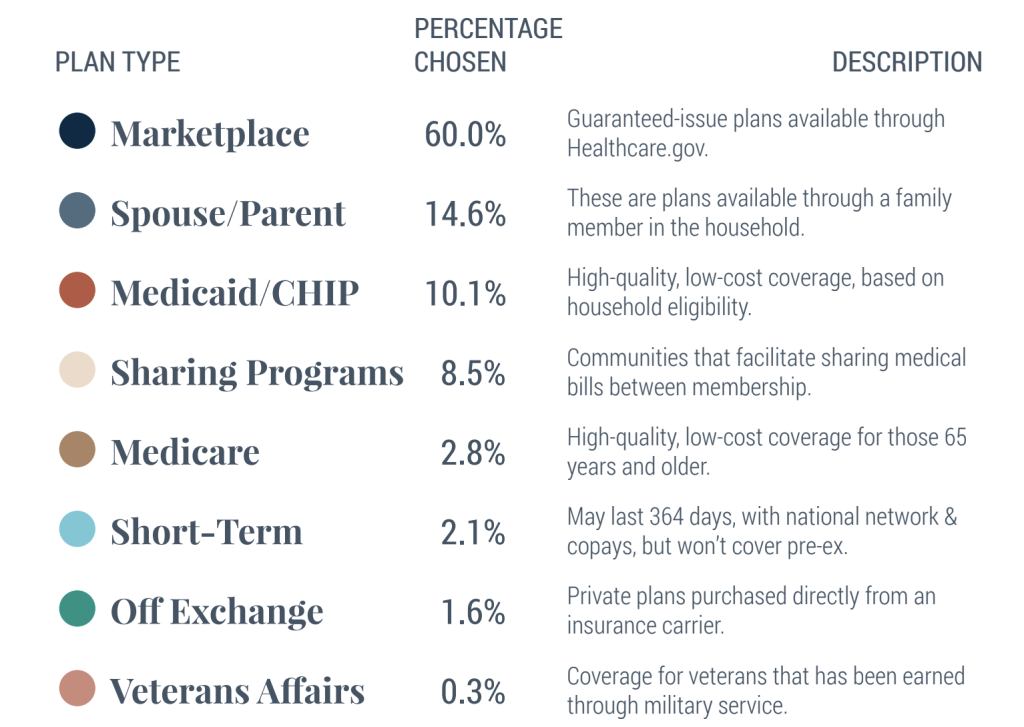

When an employer ditches their traditional group plan and switches to a managed individual method, employees have eight coverage options to choose from. These options, in order of popularity, are listed below.

Remodel Health’s Member Data determined that Marketplace plans are the most popular individual insurance choice among employees. A whopping 60% of the employees surveyed chose these guaranteed-issue plans that are available through Healthcare.gov! Spouse/Parent plans were the second most popular option, which were chosen by 14.6% of employees and are available when a family member in the household has access to a group plan through their employer. Additionally, the benefits associated with Marketplace and Spouse/Parent plans provide insight to employers. These benefits help employers understand the importance of giving employees the freedom to choose their own individualized health plans.

Why Do Employees Want These Individual Health Insurance Plans?

Offering a traditional group plan automatically closes the door on the best plans for a significant number of people on your team, since a person can’t enroll in an individual plan if they are offered a group plan through an employer. Individual health insurance plans provide so many perks for both employers and employees. Let’s break down why these popular plan choices have been consistently chosen by thousands of people!

Marketplace plans

Marketplace plans (also known as ACA plans) are high-quality and affordable plans from the carriers you’re used to. These plans are priced based on household income, which unlocks significant savings for so many employees! Another benefit of The Marketplace is choosing plans from big-name carriers like Ambetter, Anthem, CareSource, and many more. Employees love these budget-friendly plans that also provide better coverage!

Spouse/parent plans

If an employee chooses a Spouse/Parent plan, this means the employee gets to join the group plan offered by their spouse’s employer (or parent’s, if the employee is under 26)! As a result, the family deductible is now shared and both companies help cover the premium cost. Additionally, employees are able to share health benefits such as Teladoc and HSAs.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

Do Employees Choose Different Plans Each Year?

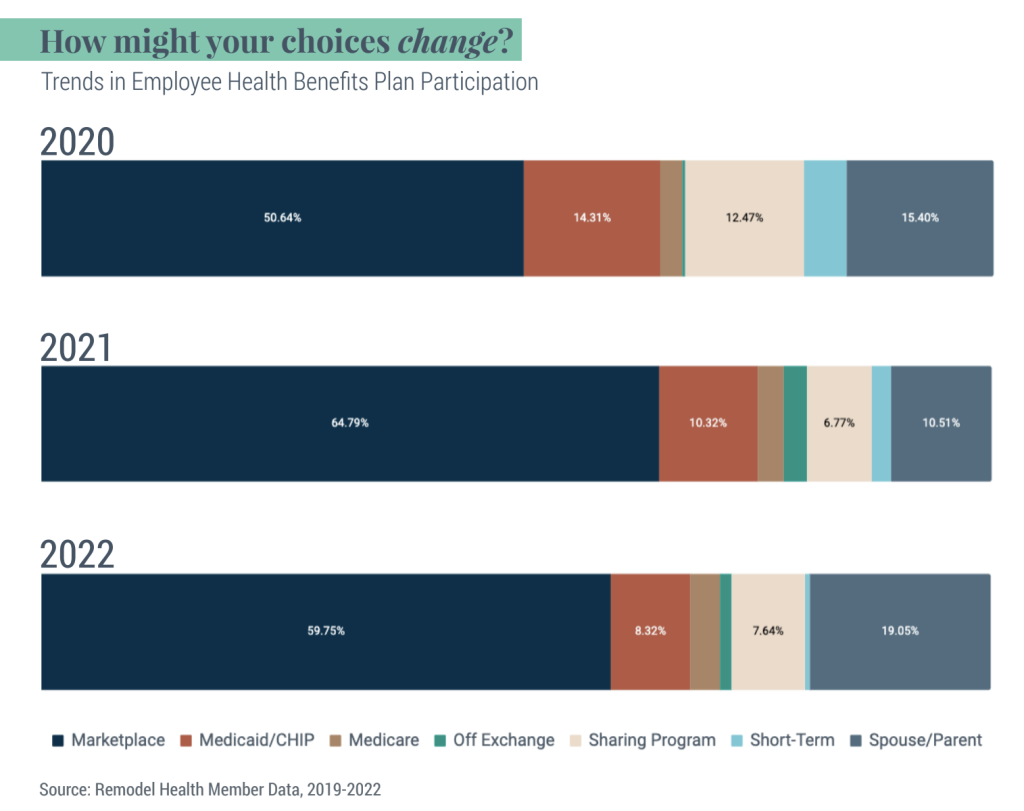

To answer this question simply, yes! When looking at health benefits data, a few trends emerge when it comes to employee choice and individual preference. From 2020 to 2021, Marketplace plan selection increased by 14.2%. This change likely resulted in growing public awareness of Advanced Premium Tax Credits and legislation that has enhanced them further. Marketplace plans have been growing wildly in popularity for about a decade!

Similarly, Spouse/Parent plan selection increased by 8.5% over a three year period. The reason for this change is attributed to the convenience of having the whole family on one plan. Sharing one plan and one deductible also limits household risks for families. It’s important to consider that various employee life changes can influence plan choices, however, this data shows the movements of individual preference.

What Does This Mean For Me?

Together, we learned that employees choose Marketplace plans when given the opportunity to select their own health plans. Spouse/Parent plans also serve as a popular choice among employees that are eligible for these plans. When an employee is choosing which individual health insurance plan is right for them, referencing other employees’ choices and industry trends can serve as helpful guidance.

Are you ready to design a health benefits plan that fits your people and company? Connect with us for a custom Health Benefits Analysis that can help revolutionize the way you deliver health benefits to your employees.

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.