In previous blogs, I’ve discussed the costs of individual health insurance plans and how government-sponsored discounts can lower those costs. These discounts are known as Advanced Premium Tax Credits (APTCs). And today, I’ll answer all your questions about APTCs in more detail.

What are Advanced Premium Tax Credits?

Advanced Premium Tax Credits are tax credits that can be taken in advance to lower the monthly premium cost of an individual health insurance plan on the Marketplace. The Affordable Care Act (ACA) established this type of tax credit to assist with the cost of Marketplace plans. The tax credit acts as a “discount” on the cost of the plan because the IRS sends the credit directly to the health insurance carrier each month, before the plan holder receives a bill.

What are Advanced Premium Tax Credits?

Tax credits you can take in advance to lower your monthly health insurance premium (healthcare.gov)

How big are the savings?

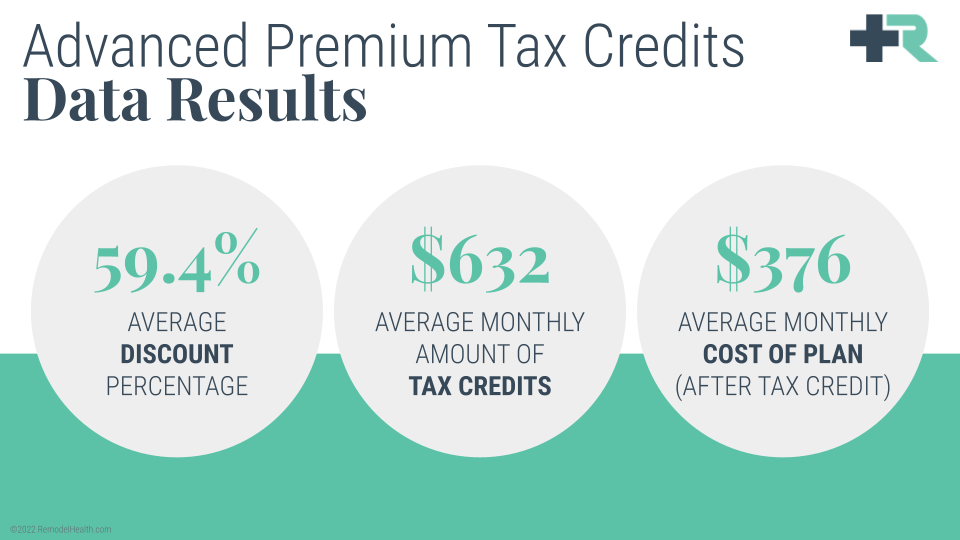

According to Remodel Health’s proprietary member data, the average discount percentage from Advanced Premium Tax Credits is 59.4%! Yes—a more than 50% discount off the cost of the individual health insurance plan is the average! The discounts from these tax credits are huge.

The amount of tax credit that an individual may be eligible for is calculated based on household income and the average cost of a silver-level individual health insurance plan in their area. On average, the total amount of tax credits for an individual adds up to about $8,950 per year. And when applicable, they can even discount a person’s monthly premium cost down to $0!

Am I eligible for Advanced Premium Tax Credits?

An individual is eligible for Advanced Premium Tax Credits when they are not offered a traditional group health insurance plan through an employer. For example, people who would fit into this category are people who:

– are self-employed (small business owners, entrepreneurs),

– work for small businesses that do not offer group health insurance,

– are unemployed, or

– are retired and not yet 65 years old.

Again, the exact amount of tax credits per person will be determined by household income. Consumers with household incomes between 100% and 400% of the Federal Poverty Level (FPL) are likely to see discounts on the costs of their plans. In fact, our data shows that 79.5% of all individuals are eligible for discounts!

79.5% of all individuals are eligible for health plan discounts from Advanced Premium Tax Credits.

Can I access Advanced Premium Tax Credits if I have a group health plan through my employer?

No. If your employer offers a traditional group health insurance plan, you are not eligible for Advanced Premium Tax Credits. Consequently, this means that if you wanted to purchase your own individual health insurance plan on the Marketplace, you’d have to pay full price.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

In summary, there are a couple key differences between individual health insurance plans and traditional group (employer-sponsored) plans. But one of the biggest differences and advantages to individual plans are tax credits! In addition to unlocking tax credit discounts, individual health insurance plans are guaranteed-issue for anyone with a pre-existing condition. And finally, if you want to find out more about the best features of individual health insurance, check out my next blog, “Individual Health Insurance vs. Traditional Group.”

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.