If you’ve been following along in our blog series all about individual health insurance, you’ve hopefully learned quite a few things. You’ve learned about the most common health insurance terms, criteria for eligibility of individual health insurance and the cost of the plans. You’ve even learned how to lower the cost of the plans with tax credit discounts. Are you still unsure about making the switch to individual health insurance? Here, we’ve provided a detailed comparison of individual health insurance versus traditional group plans. We’re sharing the facts that individual plans have been the superior choice for over a decade, and that traditional group plans are a thing of the past.

1. Individual plans are the same plans, only better.

There’s a misconception that individual health insurance plans—also known as Marketplace plans or ACA plans—are of lesser quality compared to traditional plans. This couldn’t be further from the truth. Individual plans are actually the exact same plans from big-name carriers! The only difference? Individuals and families are the perfect people to use individual plans, instead of a group of employees.

Individual health insurance plans are high-quality with various coverage levels and nationwide provider networks. But there’s a reason why this section’s heading says individual plans are “the same, only better.” Keep reading to see what I mean.

2. Individual health insurance plans are guaranteed issue.

Guaranteed issue means that individual health plans are guaranteed to be issued to people that apply for them. These plans are guaranteed to be issued, regardless of their pre-existing medical conditions or other factors, such as age or gender. Additionally, it means that someone with an individual plan will not see changes to the cost of their plan based on their future medical condition. This became the case in 2014 when several reforms to the Affordable Care Act (ACA) took effect and strengthened the power of individual health insurance plans. This is a huge win for many Americans whose medical history is no longer a factor in their eligibility to get quality health insurance!

Conversely, traditional group health insurance plans for large groups are subject to being medically underwritten. What does this mean for employers? Employees that have a higher level of health plan utilization may lead to more charges for the employers.

3. Tax credits make individual health insurance more affordable.

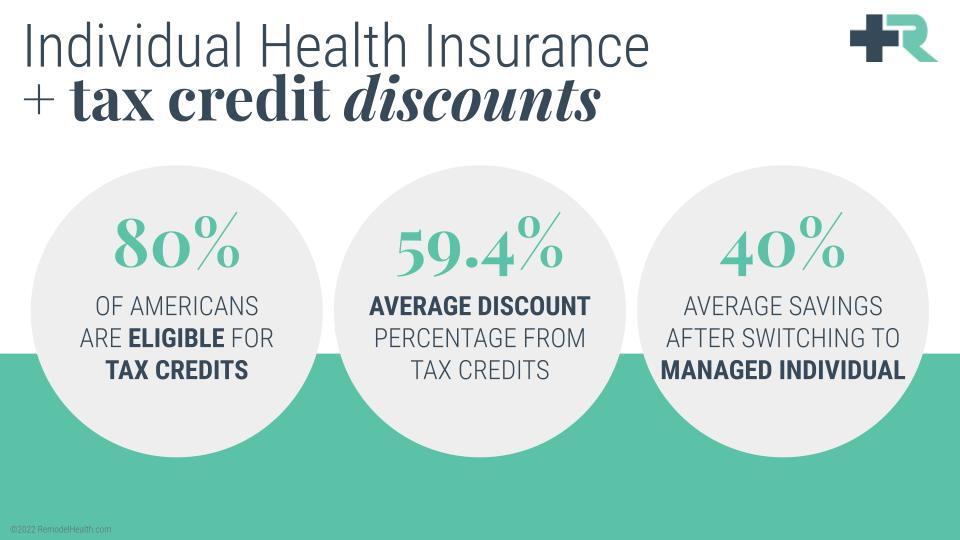

Advanced Premium Tax Credits (APTCs) make all the difference when it comes to individual plans being superior to group plans. This is because tax credits make individual plans significantly more affordable for all the people who qualify for them! And in case you’re wondering, nearly 80% of individuals are eligible for these money-saving tax credits.

APTCs discount the cost of individual health plans a whopping 59% on average. This makes the monthly cost of individual health insurance significantly lower than that of traditional group insurance. And lastly—the best statistic of them all—the managed individual method of individual plans saves employees and employers an average of 40% on healthcare when they make the switch.

Learn more about how Remodel Health’s ICHRA+® product can benefit your organization

4. There are individual health insurance options for your unique needs.

Perhaps the most compelling reason why individual health insurance plans are far greater than traditional group plans is the fact that individual plans are made for individual people and families. Gone are the days of being stuck with a one-size-never-fits-all group plan that your employer offers all employees simply to stay compliant. Say goodbye to your employer’s one-size-never-fits-all group plan! Managed Individual is the method that makes the most sense for offering employees what they actually want for group health benefits. With this method, instead of offering a group plan, employers simply give their employees the funds to purchase individual health plans on their own.

This allows each employee to enroll in a health plan that fits the needs of their household and unlocks eligibility for the employees to receive tax credit discounts on the cost of the plan.

Want to know more? Follow along and check out my next blog! I will be outlining the method of managed individual health benefits in greater detail.

Important Notice: Remodel Health does not intend to provide specific insurance, legal, or tax advice. Remodel Health always recommends consulting with your own professional representation to properly evaluate the information presented and its appropriate application to your particular situation.